Our tax dollars serve as shared investments in the programs and services that make our state a great place to live, work, and play. Tax dollars enable Montanans to work together for those things, which we cannot achieve alone – a quality education for our children, the development and maintenance of infrastructure, public safety through police and fire protection, and clean air and water. These shared investments pave the way to a stronger economy where every Montanan can thrive.

| Key Terms

Regressive Tax System – a system in which lower-income households pay a larger portion of their income in taxes compared to those households with higher incomes. Progressive Tax System – a system in which higher-income households pay a larger portion of their income in taxes compared to those households with lower incomes. |

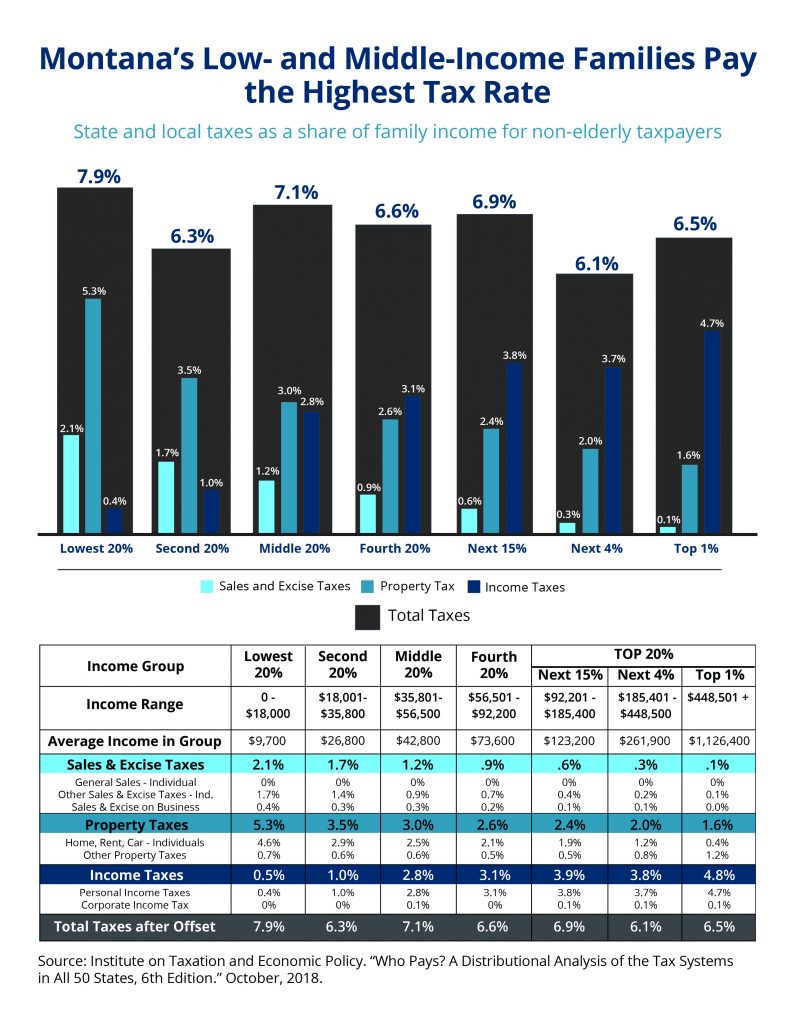

One way to evaluate a tax system is to look at how that system affects different households based on how much income they make. An analysis of Montana’s state and local taxes reveals that low-income Montanans pay higher taxes rates than those with higher incomes. In other words, Montana’s tax system is regressive. In Montana, those with incomes below $18,000 pay 7.9 percent of their income in state and local taxes, while those with income above $448,500 pay 6.5 percent.

The chart on the second page outlines the three main state and local taxes – income, property, and sales/excise - and how the cost of these taxes is distributed among taxpayers. Both property and sales/excise taxes are regressive. Conversely, income taxes are often progressive. While the income tax is progressive, it does not offset the regressive effects of the property and select excise taxes on a state and local level. Montana’s tax system would be substantially more regressive if it included a general sales tax. However, even without a sales tax, Montana’s low- and moderate-income families are facing a higher overall tax rate than wealthier households.

Policymakers have several options to ease the regressivity of Montana’s tax system. Such measures include:

Each of these options is discussed in the separate reports of MBPC’s Policy Basics revenue series that explain each type of tax – individual income, corporate income, and capital gains.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.