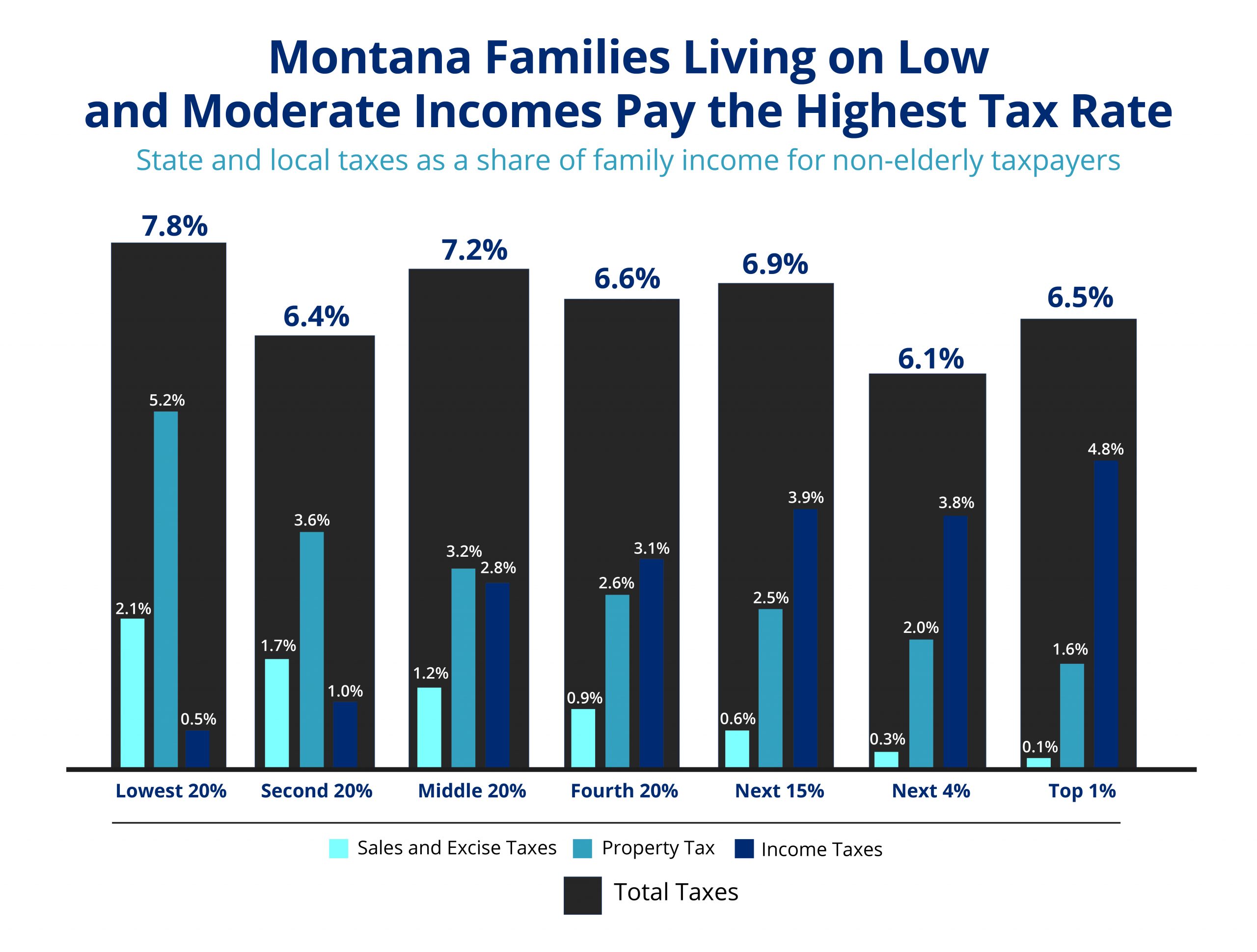

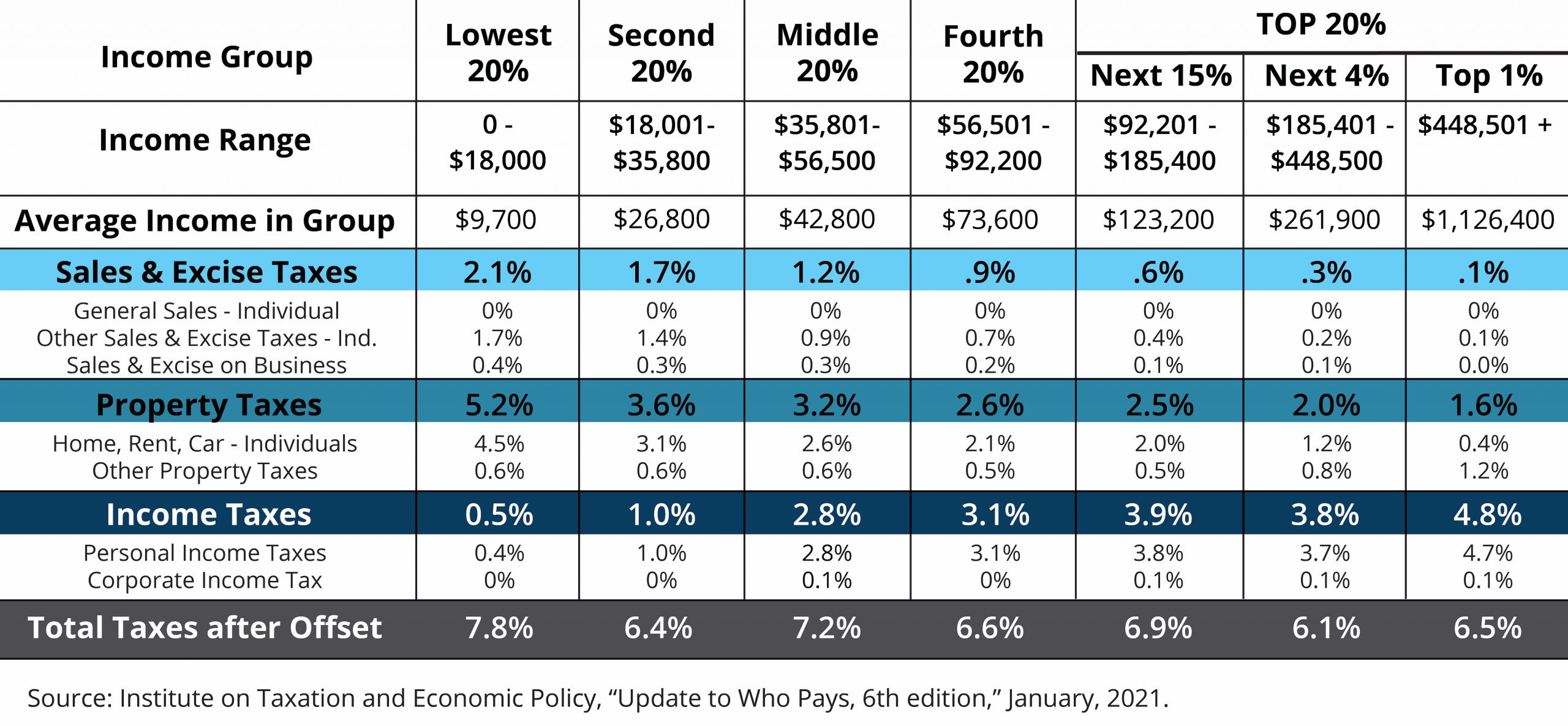

One way to evaluate a tax system is to look at how that system affects different households based on their income. An analysis of Montana’s state and local taxes reveals that Montanans living on lower incomes pay higher tax rates than those with higher incomes. In other words, Montana’s tax system is regressive. In Montana, those with incomes below $18,000 pay 7.8 percent of their income in state and local taxes, while those with income above $448,500 pay 6.5 percent.

The chart on the second page outlines the three main state and local taxes – income, property, and sales/excise - and how the cost of these taxes is distributed among taxpayers. Both property and sales/excise taxes are regressive. Conversely, income taxes are often progressive. While the income tax is progressive, it does not offset the regressivity of the property and select excise taxes on a state and local level. Montana’s tax system would be substantially more regressive if it included a general sales tax. However, even without a sales tax, Montana families living and lower and moderate incomes face a higher overall tax rate than wealthier households.

Policymakers have several options to ease the regressivity of Montana’s tax system. Such measures include:

One way to evaluate a tax system is to look at how that system affects different households based on their income. An analysis of Montana’s state and local taxes reveals that Montanans living on lower incomes pay higher tax rates than those with higher incomes. In other words, Montana’s tax system is regressive. In Montana, those with incomes below $18,000 pay 7.8 percent of their income in state and local taxes, while those with income above $448,500 pay 6.5 percent.

The chart on the second page outlines the three main state and local taxes – income, property, and sales/excise - and how the cost of these taxes is distributed among taxpayers. Both property and sales/excise taxes are regressive. Conversely, income taxes are often progressive. While the income tax is progressive, it does not offset the regressivity of the property and select excise taxes on a state and local level. Montana’s tax system would be substantially more regressive if it included a general sales tax. However, even without a sales tax, Montana families living and lower and moderate incomes face a higher overall tax rate than wealthier households.

Policymakers have several options to ease the regressivity of Montana’s tax system. Such measures include:

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.