The Crisis We Face: How Montana Can Respond to the Economic Impact of COVID-19

Mar 31, 2020

By Tara Jensen

As the nation continues to face the growing COVID-19 pandemic, Montana can continue to take proactive actions to mitigate the damage to families and the overall economy. The necessary, albeit difficult, measures taken to protect public health and reduce the spread of the virus COVID-19 has resulted in an economic downturn. However, federal and state actions are critical in mitigating the human and economic toll of these public health policies. Congress has recently enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act, providing significant relief to states, local governments, small businesses, and service providers to help weather the economic recession. Montana should consider additional steps to protect workers and families who have been impacted by COVID-19.

General Economic Outlook

Coronavirus will have a significant impact on the nation and Montana’s economy and health. During the week of March 16, 2020, the United States experienced more weekly unemployment insurance claims than any prior week in American history.

[1] On March 18, 2,830 people in Montana filed new unemployment claims, compared to 57 only one week earlier.

[2]

Much of the health and economic strife is yet to come, as coronavirus is likely to reach global pandemic levels akin to the Spanish flu of 1918-1919, or worse.

[3] Early estimates project that Montana is expected to lose over 48,000 jobs by June of 2020, representing 12.4 percent of private sector employment.

[4] Morgan Stanley and Goldman Sachs Group expect a record drop in gross domestic product (GDP) and a deep global recession.

[5] Even with the $2 trillion stimulus package, Morgan Stanley estimates GDP to drop by 25 percent in the second quarter of 2020, with overall unemployment rising to as high as 8.5 percent.

[6] Federal stimulus funds that come to the state could mitigate this effect.

The economic contraction resulting from public health measures like businesses and schools shutting down and social distancing is the right thing to do for the health of our residents, and the state and the federal government have the tools they need to mitigate much of the resulting human suffering.

Montana Revenue

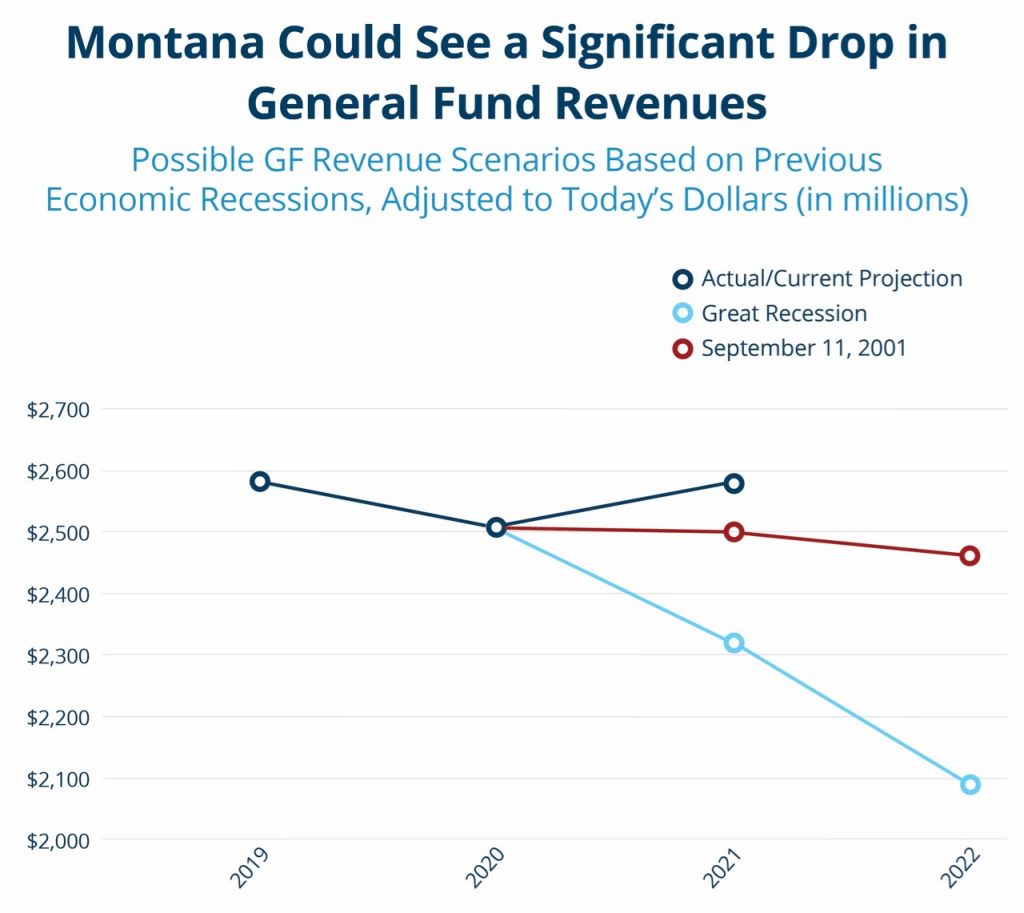

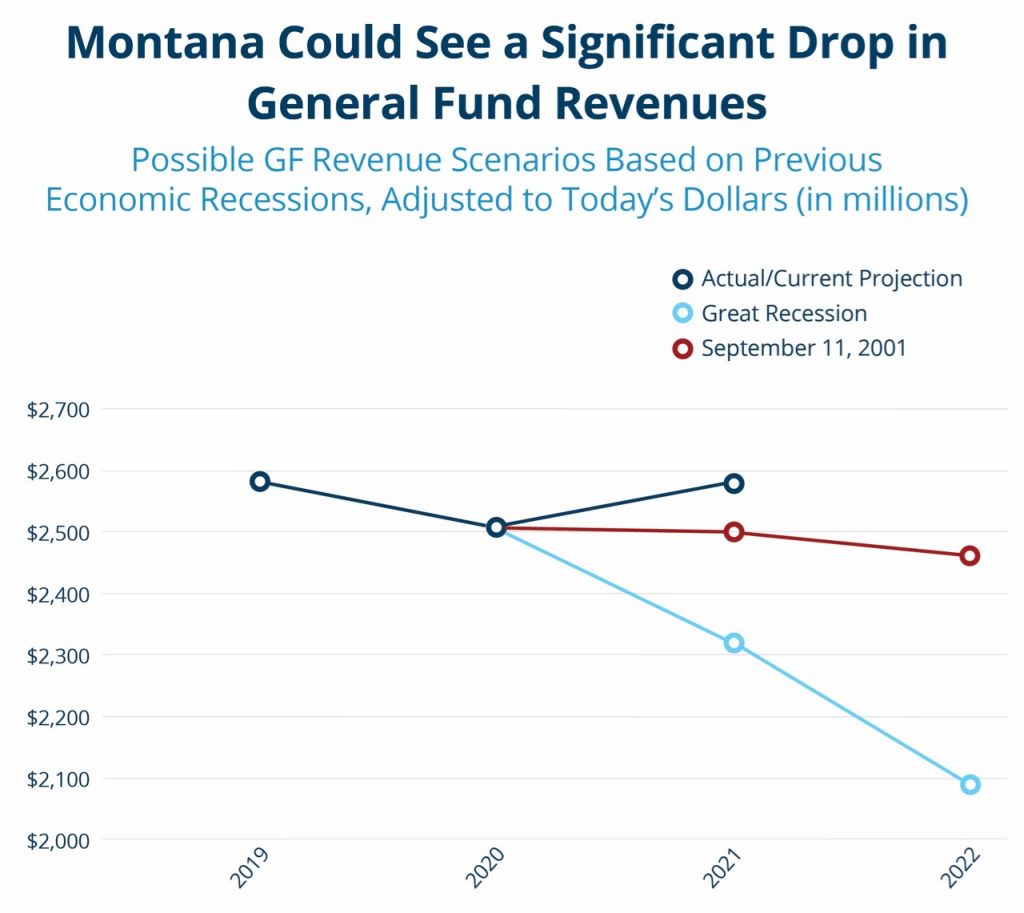

The economic slump will have an impact on Montana’s budget, and we can look to previous economic declines as a possible barometer. Individual and corporate income tax revenue makes up about half of Montana’s general fund revenue and tend to track overall economic trends. As individuals and businesses earn less, state tax collections on that income also drops. Montana experienced state revenue declines following September 11, 2001, as well as, during the Great Recession a decade ago. The following chart shows projected state revenue if Montana experienced similar percentage declines that occurred during 9/11 and the Great Recession. This chart assumes current fiscal year (FY 2020) general fund revenue will come in as projected by the 2019 Legislature in House Joint Resolution (HJ) 2.

[7] If an economic contraction today mirrored that during 9/11, it would result in general fund revenue collection coming in $77 million less than projected in HJ 2 for FY2021, with the loss of revenue increasing in FY2022. Similarly, if the economic contraction following the Great Recession occurred today, general fund revenue would come in $258 million below HJ 2 in FY 2021, with an even drop in FY 2022.

Montana’s ending fund balance and other “rainy day” funds will provide some buffer against initial revenue losses, but it is unclear whether these funds will be adequate. As of March 18, 2020, Legislative Fiscal Division estimated Montana will have $291 million ending fund balance by the end of FY 2020, as well as $118 million in the newly created Budget Stabilization Reserve Fund.

[8] Montana law requires the state to maintain a certain amount in its ending fund balance through the biennium.

[9] Montana established the Budget Stabilization Reserve Fund in 2017 to provide the executive and legislative branches with additional flexibility to withdraw funds at times when state revenue comes in lower than projected. If the governor determines revenue levels will result in the ending fund balance dipping below $100 million prior to October of 2020, the governor has the authority to transfer funds from the Budget Stabilization Reserve Fund.

[10]

Federal Government Action Will Be Critical to Support Montana Families

On March 18, 2020, President Trump signed the Families First Coronavirus Response Act, providing additional flexibility to states in providing Supplemental Nutrition Assistance Program (SNAP) and unemployment insurance (UI) benefits, as well as, new provisions providing paid sick days and paid family leave for certain workers impacted by COVID-19.

[11] On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, providing support to states through a number of federal programs. Most notably,

Montana will receive $1.25 billion in the coronavirus relief fund, which the state and local governments can use for expenditures that are necessary to respond to COVID-19 and not previously accounted for in the state or local government’s current budget. A list of the most significant emergency appropriations within the CARES Act can be found in Appendix A.

Montanans Need Assistance for Food, Health, and Basic Necessities

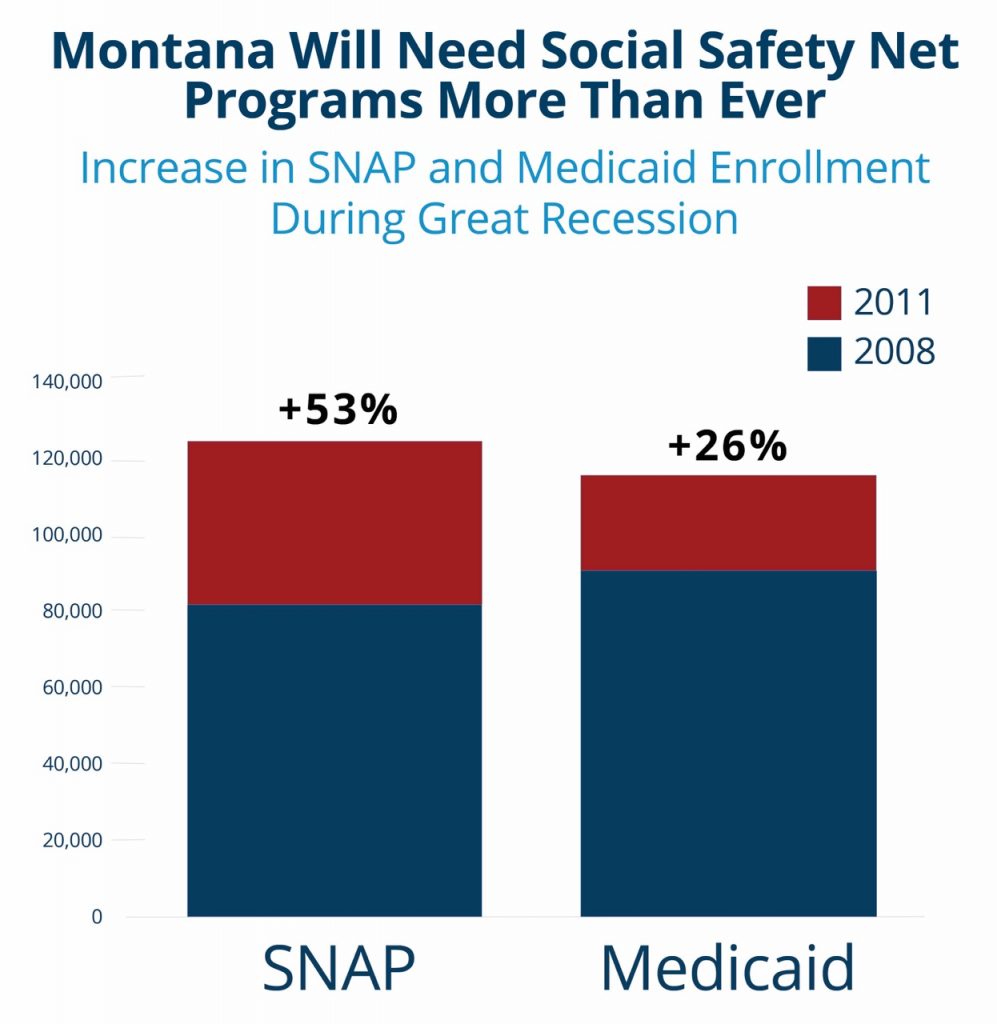

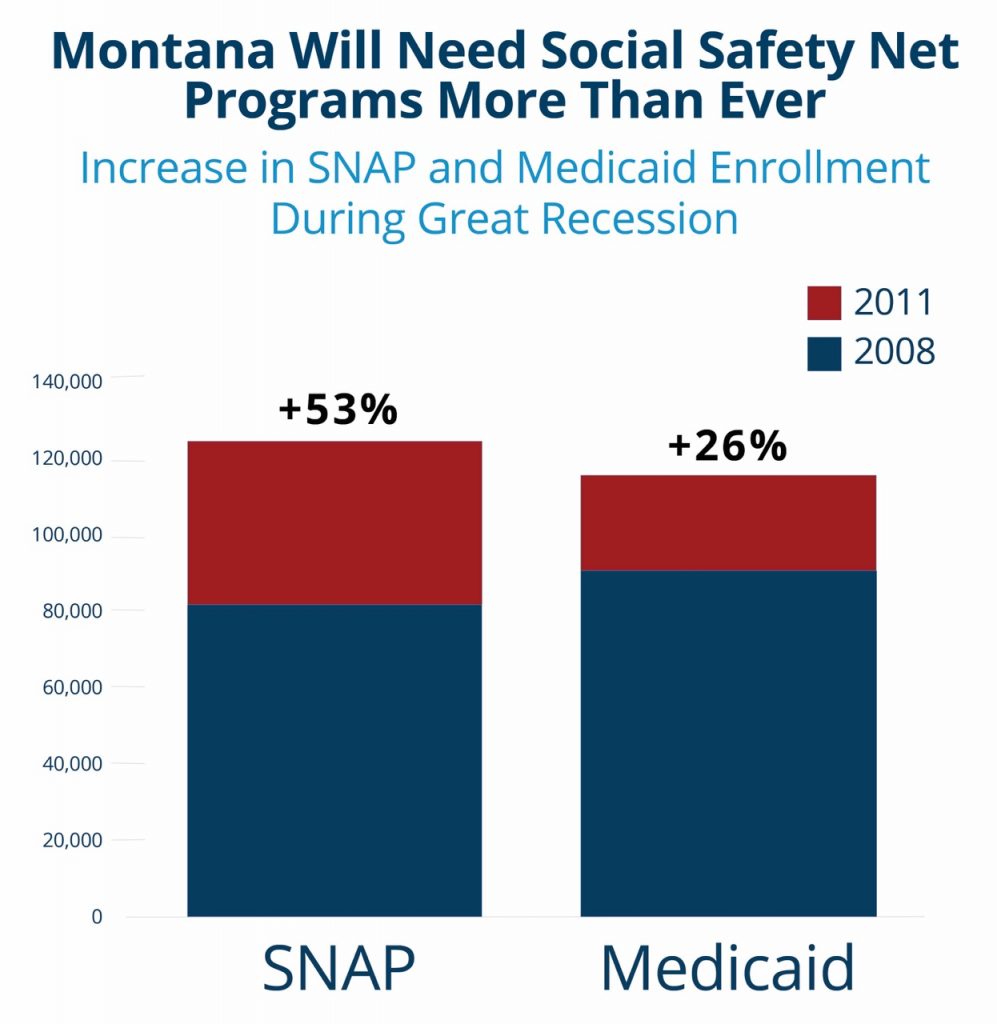

The likely decline in state revenue will be compounded by increased demand on social safety net programs. Programs, such as UI, food assistance, and Medicaid health coverage are designed to help workers and families during economic declines. During the Great Recession, Montana saw a significant increase in enrollment. From 2008 to 2011:

- The number of Montanans accessing food assistance through SNAP increased by 42,000 Montanans;[12] and

- The number of Montanans accessing Medicaid health insurance grew by 23,000 Montanans.[13]

Montana should expect similar (or even greater) increases in SNAP, Medicaid, UI, and other safety net programs as the state weathers the current economic recession. These programs provide critical support for families to cover basic necessities. Furthermore, the state has flexibility to adjust program requirements to ensure assistance is protected for those impacted by COVID-19.

Montana Actions to Support Recovery and Mitigate Impact on Workers

The coronavirus pandemic highlights the important state and federal policies that support families, including health care, housing, financial supports, and child care. Existing barriers to equity and access will be magnified for many Montanans, including: black, indigenous, and people of color; families living on low wages; rural communities; and other disproportionately impacted groups. Actions taken by state leaders should prioritize these populations in its responses.

Health Care

Our state’s Medicaid system provides crucial care and coverage for hundreds of thousands of Montanans, and the COVID-19 pandemic highlights just how important this system is. Montana should maximize Medicaid’s flexibility to address the public health crisis by taking advantage of all the pathways that can limit paperwork and streamline enrollment that the federal Center for Medicare and Medicaid Services (CMS) is making available to states.

[14] Furthermore, actions to streamline Medicaid requirements will simplify Montana’s Department of Health and Human Services (DPHHS) processes and reduce workload, especially at a time where the state is short-staffed and dealing with increased demands. Montana should:

- Leverage additional federal funds to increase public awareness and enrollment assistance through Medicaid.

- Maximize use of presumptive eligibility for all eligible Medicaid populations, through expansion of qualified entities and automated ex parte

- Reduce barriers to maintaining coverage, including waiving certain requirements, such premium requirements or asset tests.

- Utilize express lane eligibility for children newly eligible for Healthy Montana Kids, using data from SNAP, Temporary Assistance for Needy Families (TANF), and the free and reduced lunch program.

- Expand eligibility for home- and community-based services by expanding waiver slots and providing additional services needed to address COVID-19.

Child Care

Both families and child care providers are worried about how COVID-19 may impact their ability to access important child care support. Public health agencies in many areas are encouraging child care centers to close, putting significant financial strain on facilities and their workers. Furthermore, as essential workers are needed in health care and other key industries, their children will need safe, high-quality child care. Montana should consider bolstering support for child care centers and modifying rules to address COVID-19, including

[15]:

- Protect families’ access to Best Beginnings Scholarships, including temporarily waiving the absence days cap for Best Beginnings Scholarships.

- Retain scholarship payments to child care providers during closure.

- Retain ratios and group sizes in licensed child care to assure safety of children and workers.

Family Economic Security Programs

Quarantines, business closures, layoffs, and other upheavals caused by the COVID-19 pandemic are putting the financial well-being of working families at risk, especially those living paycheck-to-paycheck. Montana should consider swift and bold changes to protect and expand income security and food assistance programs.

[16],[17] Montana should:

- Enact temporary changes to waive work requirements and remove barriers on SNAP and TANF assistance.

- Calculate SNAP and TANF benefits based on prospective income and disregard any discontinued income received earlier in the month.

- Expand emergency SNAP benefits to maximum amount available and expand eligibility to cover children eligible to receive free or reduced-priced school meals.

- Clarify that current TANF emergency assistance can be used for COVID-19-related circumstances.

Housing

Many workers living on low or moderate wages and facing reduced hours or unemployment are often one missed paycheck away from facing eviction or homelessness. Furthermore, families experiencing homelessness, including those who are elderly, people with disabilities, or are health compromised, are at greater risk of severe illness from COVID-19. It is essential that the state protect housing during the public health emergency, particularly for those most at risk from COVID-19.

[18] The state should:

- Enact rental and utility protections for low-income, high-risk populations, including a moratorium on eviction notices.

- Work with financial institutions including state-regulated banks, credit unions, and servicers to protect homeowners and consumers, including establishing a grace period on mortgage payments or other relief for those impacted COVID-19.

State and Federal Policymakers Must Lead to Mitigate the Harm of COVID-19

Our communities look to government to provide protection and services in times of crisis. As Montana faces decline in state revenue but increased federal support, it will be critical for state policymakers to prioritize its actions to support families and workers living on low wages.

Montana’s ending fund balance and other “rainy day” funds will provide some buffer against initial revenue losses, but it is unclear whether these funds will be adequate. As of March 18, 2020, Legislative Fiscal Division estimated Montana will have $291 million ending fund balance by the end of FY 2020, as well as $118 million in the newly created Budget Stabilization Reserve Fund.[8] Montana law requires the state to maintain a certain amount in its ending fund balance through the biennium.[9] Montana established the Budget Stabilization Reserve Fund in 2017 to provide the executive and legislative branches with additional flexibility to withdraw funds at times when state revenue comes in lower than projected. If the governor determines revenue levels will result in the ending fund balance dipping below $100 million prior to October of 2020, the governor has the authority to transfer funds from the Budget Stabilization Reserve Fund.[10]

Montana’s ending fund balance and other “rainy day” funds will provide some buffer against initial revenue losses, but it is unclear whether these funds will be adequate. As of March 18, 2020, Legislative Fiscal Division estimated Montana will have $291 million ending fund balance by the end of FY 2020, as well as $118 million in the newly created Budget Stabilization Reserve Fund.[8] Montana law requires the state to maintain a certain amount in its ending fund balance through the biennium.[9] Montana established the Budget Stabilization Reserve Fund in 2017 to provide the executive and legislative branches with additional flexibility to withdraw funds at times when state revenue comes in lower than projected. If the governor determines revenue levels will result in the ending fund balance dipping below $100 million prior to October of 2020, the governor has the authority to transfer funds from the Budget Stabilization Reserve Fund.[10]

Montana should expect similar (or even greater) increases in SNAP, Medicaid, UI, and other safety net programs as the state weathers the current economic recession. These programs provide critical support for families to cover basic necessities. Furthermore, the state has flexibility to adjust program requirements to ensure assistance is protected for those impacted by COVID-19.

Montana should expect similar (or even greater) increases in SNAP, Medicaid, UI, and other safety net programs as the state weathers the current economic recession. These programs provide critical support for families to cover basic necessities. Furthermore, the state has flexibility to adjust program requirements to ensure assistance is protected for those impacted by COVID-19.