Making Montana’s Tax System Work for All Montanans

Jun 04, 2019

By Tara Jensen

The cornerstones of our communities rest on modern schools, safe roads, reliable water systems, and responsive public safety services. A healthy state budget ensures we can invest in and build up a solid foundation for our state and communities. Unfortunately, declining state revenues threaten Montana’s ability to adequately invest in the public institutions that educate our children, keep our communities safe, and provide healthcare and other services to families across the state. House Joint Resolution 35, passed by the 2019 Montana Legislature, proposes that the revenue interim committee “study Montana’s state and local tax systems and make recommendations about whether to revise the state’s current tax structure.”

[1] The committee is charged with considering changes to the tax code to:

- Establish a tax structure that works with the current economy;

- Stabilize state revenue and reduce volatility;

- Promote the long-term economic prosperity of the state and its citizens;

- Reflect principles of sound tax policy, including simplicity, competitiveness, efficiency, predictability, stability, and ease of compliance and administration;

- Ensure the tax structure is fair and equitable; and

- Allow Montana to compete with other states and nations for jobs and investments.

Lower- and Middle-Income Households in Montana Pay a Higher Tax Rate

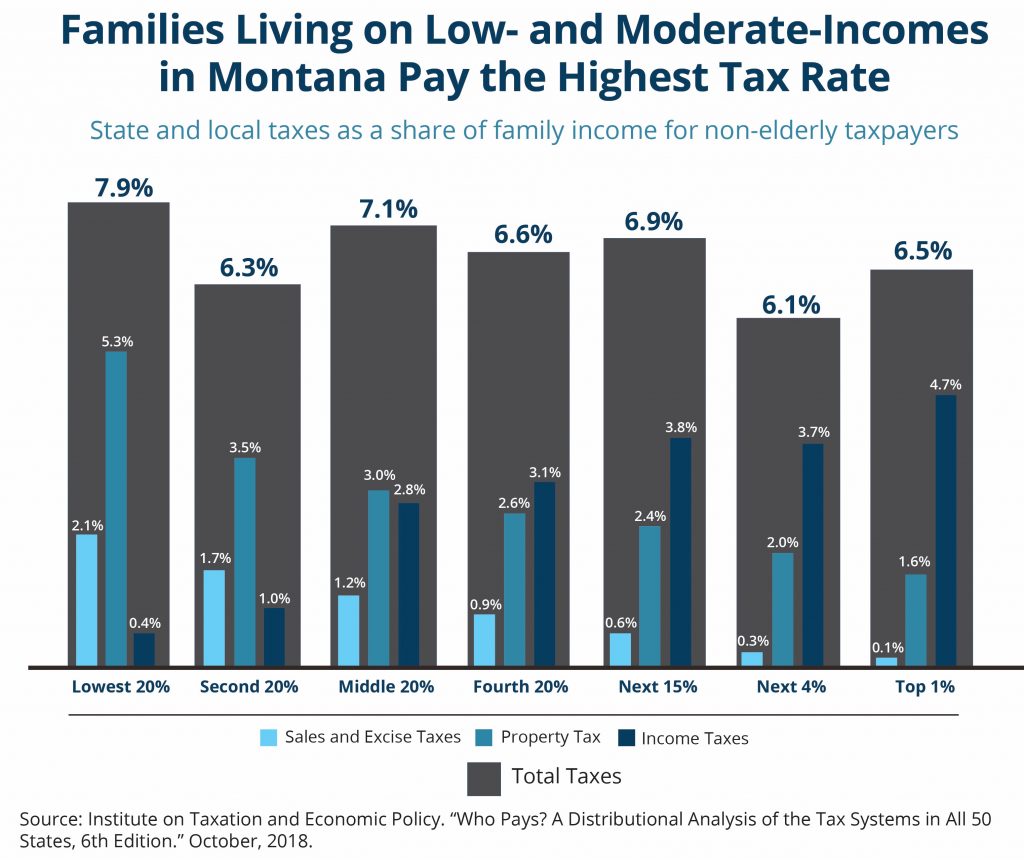

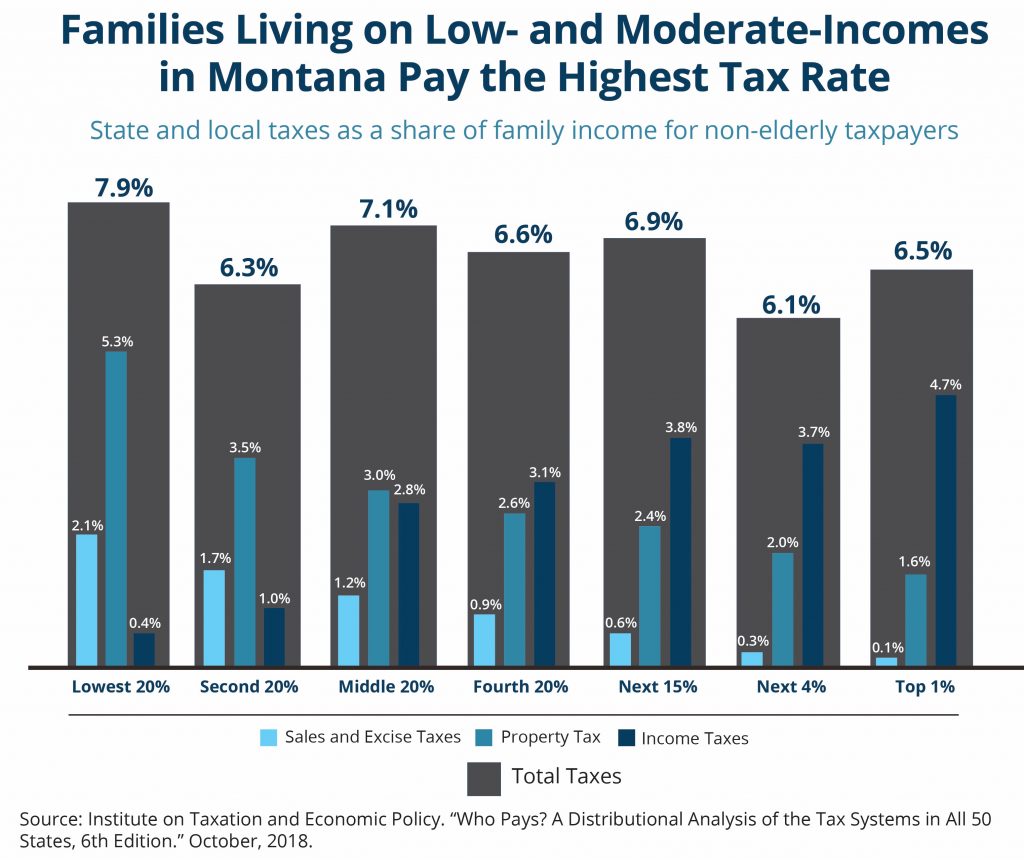

In evaluating the tax system of Montana, policymakers should keep in mind how our taxes affect households at different income levels. Montana’s tax system is regressive, meaning families living on low- and middle-incomes pay a higher percentage of their income in taxes than high-income households. In Montana, those with incomes below $18,000 pay 7.9 percent of their income in state and local taxes, while the top 1 percent (those with income above $448,500) pay 6.5 percent.

[2]

The following chart outlines the three main state and local taxes - income, property, and sales/excise - and how the cost of these taxes is distributed among taxpayers. Both property and sales/excise taxes are

regressive. Conversely, state income taxes in Montana are

progressive. While the income tax is progressive, it does not offset the regressive effects of the property and select excise taxes on a state and local level. Montana’s tax system would be substantially

more regressive if it included a general sales tax. However, even without a sales tax, families in Montana living on low- and moderate-incomes face a higher overall tax rate than wealthier households.

Overarching Principles for Successful State Tax Studies

Overarching Principles for Successful State Tax Studies

As Montana policymakers consider studying the state’s overall tax system, Montana can learn from 22 states and the District of Columbia that have successfully embarked on similar efforts in the last decade.

[3] The Legislative Revenue Interim Committee should take into consideration the following lessons learned:

- Tax commissions should avoid deep tax cuts without offsetting tax increases, as most state budgets are already stretched thin;

- Tax commission reports should include a range of proposals and show advantages and disadvantages of each specific proposal with revenue estimates;

- Tax commissions should have diverse memberships and hear from multiple perspectives;

- Tax commissions advocating dramatic overhauls of state tax structure did not produce results;

- Tax commissions stacked with members from only one side of the ideological spectrum saw proposals struggle;

- Tax commissions should evaluate the tax system from multiple lenses, including race, income groups, and other socioeconomic indicators; and

- Tax commissions should recognize the limitations of tax policy in influencing economic development, as scholars have yet to come to consensus on which tax policy proposals, if any, are effective in shaping business decisions.[4],[5]

Principles of a High-Quality State Revenue System

The National Conference of State Legislatures recommends nine principles of high-quality state revenue systems, which are good guidelines for policy proposals from state tax commissions.

[6] A high quality state revenue system:

- Is comprised of elements that are complementary, including finances of both state and local governments;

- Produces revenue in a reliable manner involving stability, certainty, and sufficiency;

- Relies on a balanced variety of revenue sources;

- Treats individuals equitably by implementing similar tax responsibility on people in similar circumstances and minimizing taxes on those living on low-incomes;

- Facilitates taxpayer compliance by creating a system that is easy to understand and minimizes compliance costs;

- Promotes fair, efficient, and effective administration;

- Is responsive to interstate and international economic competition;

- Minimizes its involvement in spending decisions and makes any involvement explicit; and

- Is accountable to taxpayers.

As Montana sets forth on a study of the state tax system, policymakers should ensure: a diverse make-up of study members; specific, carefully analyzed recommendations; and close consideration of the nine principles of a high-quality revenue system, in order to move good tax policy forward. A high-quality tax system will help Montana to balance a healthy state budget with positive impacts on our state and communities.

Overarching Principles for Successful State Tax Studies

As Montana policymakers consider studying the state’s overall tax system, Montana can learn from 22 states and the District of Columbia that have successfully embarked on similar efforts in the last decade.[3] The Legislative Revenue Interim Committee should take into consideration the following lessons learned:

Overarching Principles for Successful State Tax Studies

As Montana policymakers consider studying the state’s overall tax system, Montana can learn from 22 states and the District of Columbia that have successfully embarked on similar efforts in the last decade.[3] The Legislative Revenue Interim Committee should take into consideration the following lessons learned: