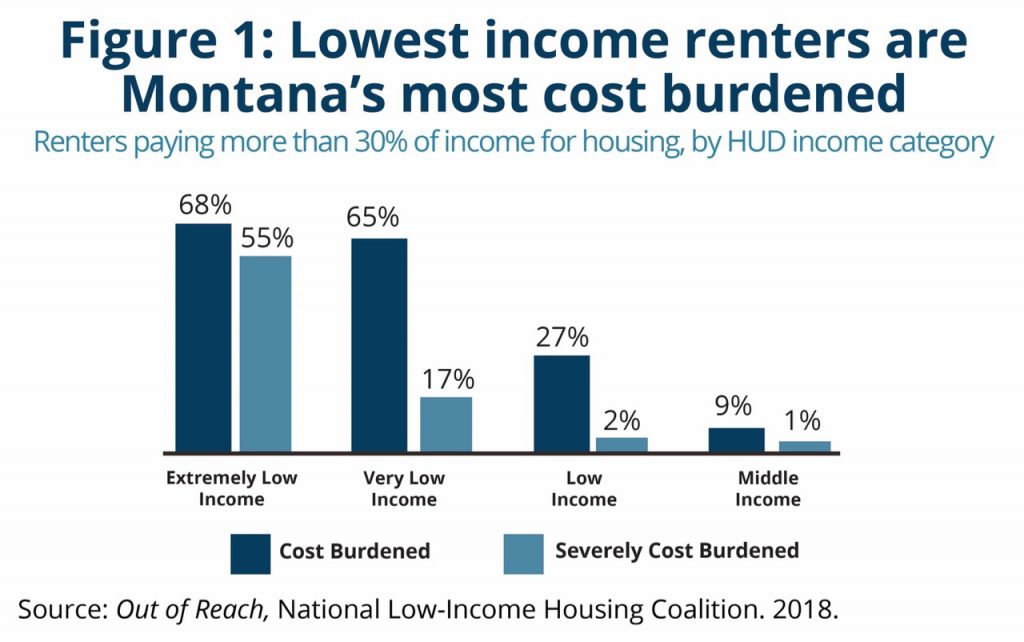

In Montana, 39 percent of all renters are cost burdened.[7] One in four renters are considered extremely low-income and, of these households, 68 percent are paying rents that are unaffordable (see Figure 1).[8] The majority of extremely low-income renters are seniors or people with disabilities (57 percent) or are working (36 percent).[9]

The gap between wages and housing costs makes finding an affordable home increasingly out of reach for workers, and a full-time job does not ensure access to safe and stable housing. One in four jobs in Montana are in low pay occupations, with annual earnings below the poverty line for a family of four ($24,300).[10] Workers without affordable housing make up a large share of the low wage workforce, with more than a third of extremely low-income renters employed in the service industry, which includes retail workers, home health aides, and those working in food services.[11]

In Montana, 39 percent of all renters are cost burdened.[7] One in four renters are considered extremely low-income and, of these households, 68 percent are paying rents that are unaffordable (see Figure 1).[8] The majority of extremely low-income renters are seniors or people with disabilities (57 percent) or are working (36 percent).[9]

The gap between wages and housing costs makes finding an affordable home increasingly out of reach for workers, and a full-time job does not ensure access to safe and stable housing. One in four jobs in Montana are in low pay occupations, with annual earnings below the poverty line for a family of four ($24,300).[10] Workers without affordable housing make up a large share of the low wage workforce, with more than a third of extremely low-income renters employed in the service industry, which includes retail workers, home health aides, and those working in food services.[11]

Despite seeing the fourth fastest wage growth in the last decade, wages in Montana remain very low compared to the national average, ranking 45th lowest of all the states.[12] Although Montana’s economic growth today is driven by the service industry -- with retail, accommodation, and food services projected to add over 1,000 new jobs per year and over $70 million to GDP -- earnings for these jobs remain skewed towards low and minimum wage.[13] As a result, many working Montanans pay larger shares of their income towards rent.

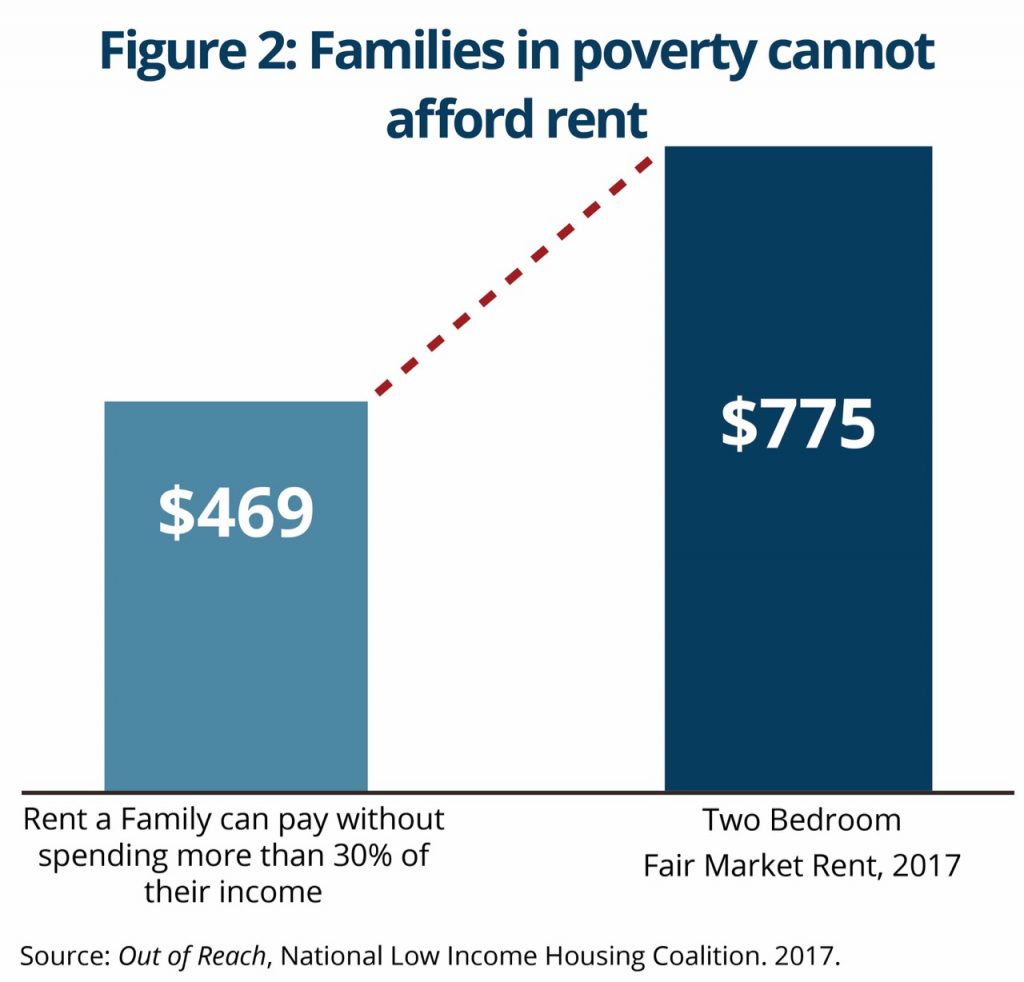

A family living in poverty should pay no more than $469 for housing to be affordable (see Figure 2). In 2017, the fair market rent in Montana for a two-bedroom home was $775 a month.[14] In order to afford this, a worker would need to earn $14.90 per hour. A single working mother earning minimum wage ($8.15/hr) would need to work 73 hours a week to afford a two-bedroom apartment.

Despite seeing the fourth fastest wage growth in the last decade, wages in Montana remain very low compared to the national average, ranking 45th lowest of all the states.[12] Although Montana’s economic growth today is driven by the service industry -- with retail, accommodation, and food services projected to add over 1,000 new jobs per year and over $70 million to GDP -- earnings for these jobs remain skewed towards low and minimum wage.[13] As a result, many working Montanans pay larger shares of their income towards rent.

A family living in poverty should pay no more than $469 for housing to be affordable (see Figure 2). In 2017, the fair market rent in Montana for a two-bedroom home was $775 a month.[14] In order to afford this, a worker would need to earn $14.90 per hour. A single working mother earning minimum wage ($8.15/hr) would need to work 73 hours a week to afford a two-bedroom apartment.

Seniors and those with disabilities who live on a fixed income face an even greater burden. An individual relying on Social Security can afford to pay no more than $221 a month for their housing.[15] Affordability challenges are projected to worsen for the aging population, given that those aged 55 and older make up Montana’s fastest growing population.

Rental Assistance Provides Critical, but Inadequate, Support

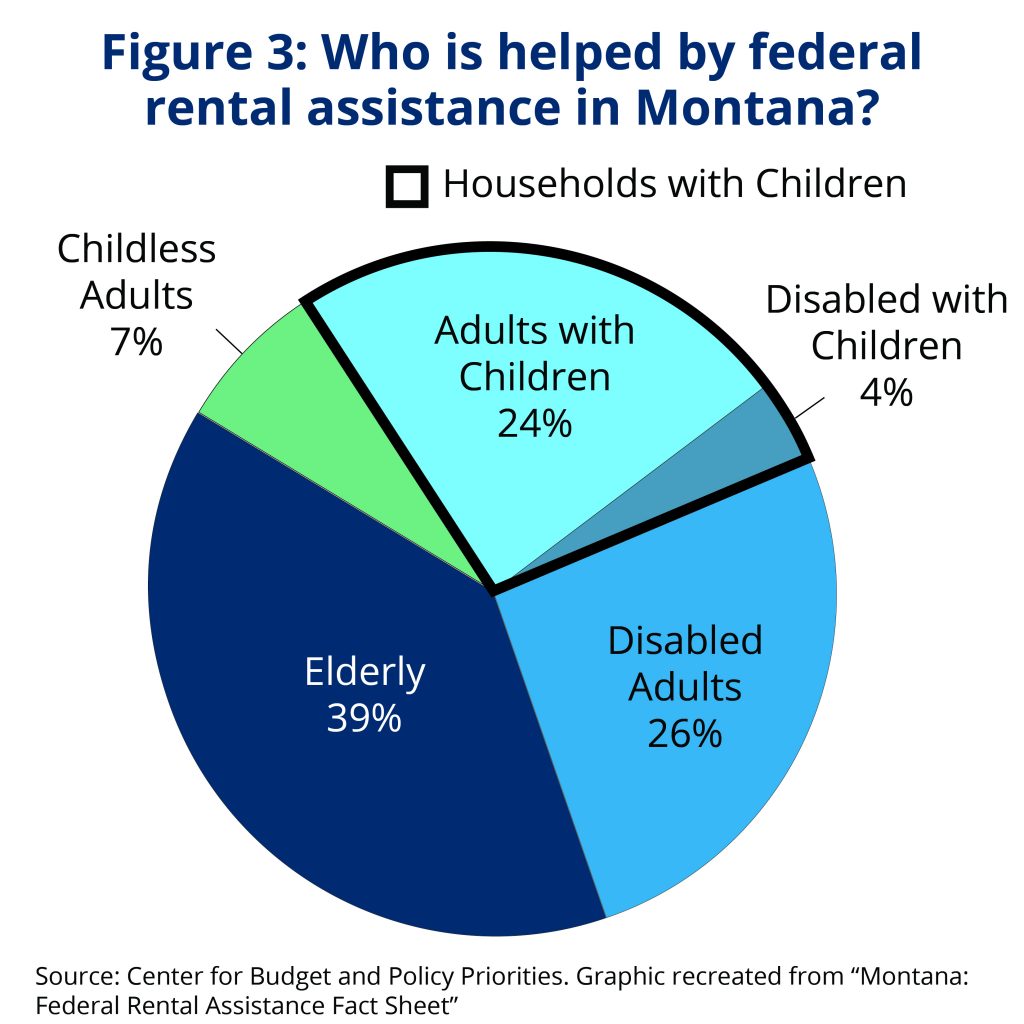

Across Montana, 14,000 households use federal housing assistance to keep a roof over their heads and nearly all (93 percent) assisted households include families with children and people who are disabled.[16] Housing Choice Vouchers (HCV) are the largest source of federal housing support, a program that allows families to spend 30 percent of their income on rent with HCV paying the difference.[17] The amount of federal resources, however, does not come close to meeting Montana’s housing needs and most low-income, cost burdened renters do not receive assistance. Today, 29,000 low-income households, the majority of whom live below the poverty level, spend more than half of their income on rent.[18] This represents a 30 percent increase compared to a decade ago. Of those receiving assistance, the vast majority are families with children or are seniors or individuals with disabilities (see Figure 3). Federal guidelines require that at least 75 percent of households admitted to the voucher program are extremely low-income (in Montana, about $16,900 for a family of three).[19], [20] However, the vast majority of Montana voucher holders have considerably lower incomes, earning an average of $11,700 a year.[21]

Seniors and those with disabilities who live on a fixed income face an even greater burden. An individual relying on Social Security can afford to pay no more than $221 a month for their housing.[15] Affordability challenges are projected to worsen for the aging population, given that those aged 55 and older make up Montana’s fastest growing population.

Rental Assistance Provides Critical, but Inadequate, Support

Across Montana, 14,000 households use federal housing assistance to keep a roof over their heads and nearly all (93 percent) assisted households include families with children and people who are disabled.[16] Housing Choice Vouchers (HCV) are the largest source of federal housing support, a program that allows families to spend 30 percent of their income on rent with HCV paying the difference.[17] The amount of federal resources, however, does not come close to meeting Montana’s housing needs and most low-income, cost burdened renters do not receive assistance. Today, 29,000 low-income households, the majority of whom live below the poverty level, spend more than half of their income on rent.[18] This represents a 30 percent increase compared to a decade ago. Of those receiving assistance, the vast majority are families with children or are seniors or individuals with disabilities (see Figure 3). Federal guidelines require that at least 75 percent of households admitted to the voucher program are extremely low-income (in Montana, about $16,900 for a family of three).[19], [20] However, the vast majority of Montana voucher holders have considerably lower incomes, earning an average of $11,700 a year.[21]

The amount of federal resources does not come close to meeting housing needs. There are roughly 3,340 renters supported by housing choice vouchers in counties across Montana, with twice as many applicants (6,762) on waiting lists.[22] Unlike other critical safety net programs, like Supplemental Nutrition Assistance Program (SNAP), that adapt according to community and family needs, rental assistance is not an entitlement and these benefits are not provided to all those who qualify. Public housing authorities contend with growing numbers of applicants for housing support while levels of federal funding steadily decline. The federal government spent $2.9 billion less on housing assistance in 2015 than it did in 2004.[23] Over this period, the share of housing vouchers going to Montana families fell 20 percent, a shift that reflects more seniors and adults with disabilities using assistance and a larger share of vouchers targeted towards homeless populations.[24]

Local communities have felt the impacts of decades of federal disinvestment. For example, in 2008, the Helena Housing Authority received $600,000 to distribute in rental assistance. By 2016, it had lost $170,000 in federal dollars.[25] Meanwhile, over 600 families in Helena sit on a waitlist for assistance.[26] The unmet need for housing vouchers is most severe in Great Falls, where more than 1,330 families wait for a voucher to become available. Depending on the county and level of demand, an applicant can wait between 18 months to seven years to receive assistance.[27]

Rental Assistance Supports Family Security and Healthy Children

A stable and affordable home is the foundation of a family’s health and financial security and a child’s academic and future success. For households burdened by unaffordable rent costs, there is little left over to pay for food, transportation, and health care. Many families find themselves one financial setback from losing their homes. Housing assistance can help cost burdened families at risk for housing instability and homelessness achieve long-term stability, improve a child’s educational and adult outcomes, and significantly reduce poverty rates for families and their children.

Financially Secure and Healthy Families

Rental support plays a critical role in the fight against poverty, lifting four million people above the poverty line in 2015.[28] Limiting housing costs allows low-income families to direct more of their resources towards better food, education, and savings which directly improves quality of life and financial security. The impact of housing benefits is so substantial that increasing assistance to a targeted group of 2.6 million rent burdened families could decrease child poverty by as much as 21 percent.[29]

The amount of federal resources does not come close to meeting housing needs. There are roughly 3,340 renters supported by housing choice vouchers in counties across Montana, with twice as many applicants (6,762) on waiting lists.[22] Unlike other critical safety net programs, like Supplemental Nutrition Assistance Program (SNAP), that adapt according to community and family needs, rental assistance is not an entitlement and these benefits are not provided to all those who qualify. Public housing authorities contend with growing numbers of applicants for housing support while levels of federal funding steadily decline. The federal government spent $2.9 billion less on housing assistance in 2015 than it did in 2004.[23] Over this period, the share of housing vouchers going to Montana families fell 20 percent, a shift that reflects more seniors and adults with disabilities using assistance and a larger share of vouchers targeted towards homeless populations.[24]

Local communities have felt the impacts of decades of federal disinvestment. For example, in 2008, the Helena Housing Authority received $600,000 to distribute in rental assistance. By 2016, it had lost $170,000 in federal dollars.[25] Meanwhile, over 600 families in Helena sit on a waitlist for assistance.[26] The unmet need for housing vouchers is most severe in Great Falls, where more than 1,330 families wait for a voucher to become available. Depending on the county and level of demand, an applicant can wait between 18 months to seven years to receive assistance.[27]

Rental Assistance Supports Family Security and Healthy Children

A stable and affordable home is the foundation of a family’s health and financial security and a child’s academic and future success. For households burdened by unaffordable rent costs, there is little left over to pay for food, transportation, and health care. Many families find themselves one financial setback from losing their homes. Housing assistance can help cost burdened families at risk for housing instability and homelessness achieve long-term stability, improve a child’s educational and adult outcomes, and significantly reduce poverty rates for families and their children.

Financially Secure and Healthy Families

Rental support plays a critical role in the fight against poverty, lifting four million people above the poverty line in 2015.[28] Limiting housing costs allows low-income families to direct more of their resources towards better food, education, and savings which directly improves quality of life and financial security. The impact of housing benefits is so substantial that increasing assistance to a targeted group of 2.6 million rent burdened families could decrease child poverty by as much as 21 percent.[29]  Homelessness takes a severe toll on the health of families and poses huge costs to society. While it is difficult to measure the total financial impact of homelessness, the comprehensive No Longer Homeless in Montana survey estimates that publicly funded services, including emergency shelters, hospitals, and law enforcement, can spend upwards of $23,000 annually to care for a single chronically homeless individual.[51] More communities find that it is far less expensive to keep people housed than allowing individuals to cycle between shelters, hospitals, and other emergency facilities. Housing First programs prioritize finding and maintaining stable housing and providing long-term rent assistance. This model of addressing housing before a person’s other needs is more effective and less costly way to tackle homelessness.[52] The results from a pilot supportive housing program in Bozeman estimated that the city’s public services spend a combined $28,000 annually per chronically homeless, high-need individual.[53] Providing long-term housing assistance and health care for the same high-need individual was considerably less, at $11,800 per person. Further, this individual was also less likely to use emergency rooms as primary care or become homeless again.[54]

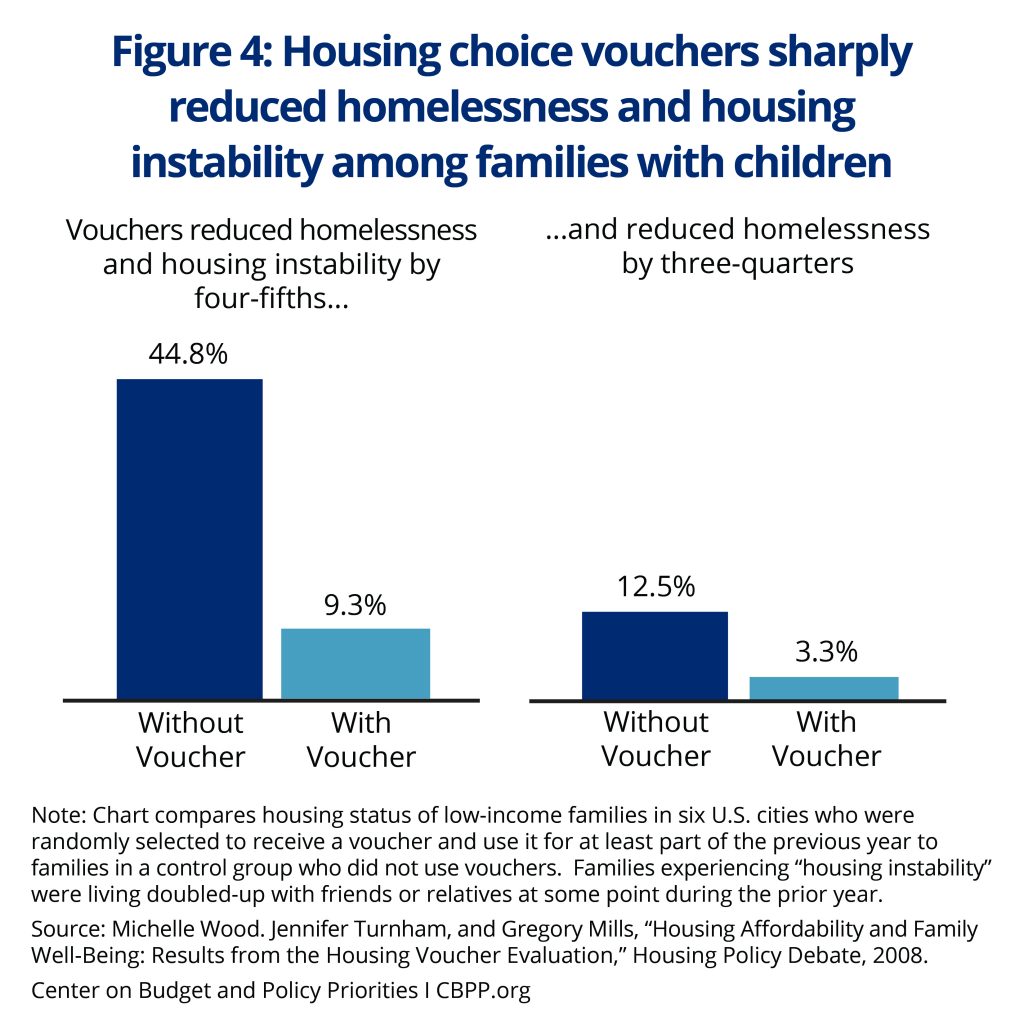

When coupled with coordinated services, housing choice vouchers are effective tools that sharply reduce homelessness and stabilize at-risk families. A multi-year evaluation of low-income families with children found that vouchers decreased the number of families living in shelters or on the streets by three-fourths and cut the number of family moves by nearly 40 percent. [55] A separate study of families living in homeless shelters showed that families who were given vouchers were half as less likely to experience another episode of homelessness and 42 percent less likely to have their children placed into foster care.[56] Furthermore, providing vouchers for these families was significantly less costly than the assistance provided through emergency shelter care and transitional housing.

Affordable Housing Strengthens Local Businesses and Our Economy

An adequate supply of affordable homes is essential for local businesses and economies to attract the workforce needed to grow. Each dollar invested in affordable housing construction and rehabilitation creates jobs, boosts local spending, and increases tax revenue that can be reinvested in schools, hospitals, and other critical institutions and services.

Helps Businesses Retain Workers and Stay Competitive

Investing federal and state dollars in constructing and maintaining low cost housing will preserve affordability for working families and allow employers to hire the workforce they need. Thousands of new low-to-middle wage jobs have increased demand for affordable housing, and the lack of housing options has become a barrier to business growth. An overwhelming number of Montanans report that employers, particularly in rural communities, have difficulty finding workers due to a lack of affordable housing.[57]

Businesses take a hit when job seekers are priced out of the local housing market. The city of Whitefish, for example, has seen market rents increase by 50 percent from 2010 to 2016, and its current rent costs are unaffordable for over 70 percent of renter households living in the area.[58] Scarce rental availability for workers has led to severe labor shortages and local businesses struggle with increasing job vacancies, with approximately 225 year-round and 140 seasonal jobs going unfilled in 2016. Nearly one in three employers in Whitefish report that they recently had an employee leave or decline a job offer because that employee found a job closer to a place they can afford to live.[59]

Bringing the cost of housing down can save local businesses money associated with high employee turnover rates. A meta-analysis on the costs of turnover across various industries demonstrated that replacing a single worker earning $30,000 or less annually can cost a business 16 percent of that employee’s salary.[60] By this estimate, a Montana business could save $4,800 by retaining one employee.

Homelessness takes a severe toll on the health of families and poses huge costs to society. While it is difficult to measure the total financial impact of homelessness, the comprehensive No Longer Homeless in Montana survey estimates that publicly funded services, including emergency shelters, hospitals, and law enforcement, can spend upwards of $23,000 annually to care for a single chronically homeless individual.[51] More communities find that it is far less expensive to keep people housed than allowing individuals to cycle between shelters, hospitals, and other emergency facilities. Housing First programs prioritize finding and maintaining stable housing and providing long-term rent assistance. This model of addressing housing before a person’s other needs is more effective and less costly way to tackle homelessness.[52] The results from a pilot supportive housing program in Bozeman estimated that the city’s public services spend a combined $28,000 annually per chronically homeless, high-need individual.[53] Providing long-term housing assistance and health care for the same high-need individual was considerably less, at $11,800 per person. Further, this individual was also less likely to use emergency rooms as primary care or become homeless again.[54]

When coupled with coordinated services, housing choice vouchers are effective tools that sharply reduce homelessness and stabilize at-risk families. A multi-year evaluation of low-income families with children found that vouchers decreased the number of families living in shelters or on the streets by three-fourths and cut the number of family moves by nearly 40 percent. [55] A separate study of families living in homeless shelters showed that families who were given vouchers were half as less likely to experience another episode of homelessness and 42 percent less likely to have their children placed into foster care.[56] Furthermore, providing vouchers for these families was significantly less costly than the assistance provided through emergency shelter care and transitional housing.

Affordable Housing Strengthens Local Businesses and Our Economy

An adequate supply of affordable homes is essential for local businesses and economies to attract the workforce needed to grow. Each dollar invested in affordable housing construction and rehabilitation creates jobs, boosts local spending, and increases tax revenue that can be reinvested in schools, hospitals, and other critical institutions and services.

Helps Businesses Retain Workers and Stay Competitive

Investing federal and state dollars in constructing and maintaining low cost housing will preserve affordability for working families and allow employers to hire the workforce they need. Thousands of new low-to-middle wage jobs have increased demand for affordable housing, and the lack of housing options has become a barrier to business growth. An overwhelming number of Montanans report that employers, particularly in rural communities, have difficulty finding workers due to a lack of affordable housing.[57]

Businesses take a hit when job seekers are priced out of the local housing market. The city of Whitefish, for example, has seen market rents increase by 50 percent from 2010 to 2016, and its current rent costs are unaffordable for over 70 percent of renter households living in the area.[58] Scarce rental availability for workers has led to severe labor shortages and local businesses struggle with increasing job vacancies, with approximately 225 year-round and 140 seasonal jobs going unfilled in 2016. Nearly one in three employers in Whitefish report that they recently had an employee leave or decline a job offer because that employee found a job closer to a place they can afford to live.[59]

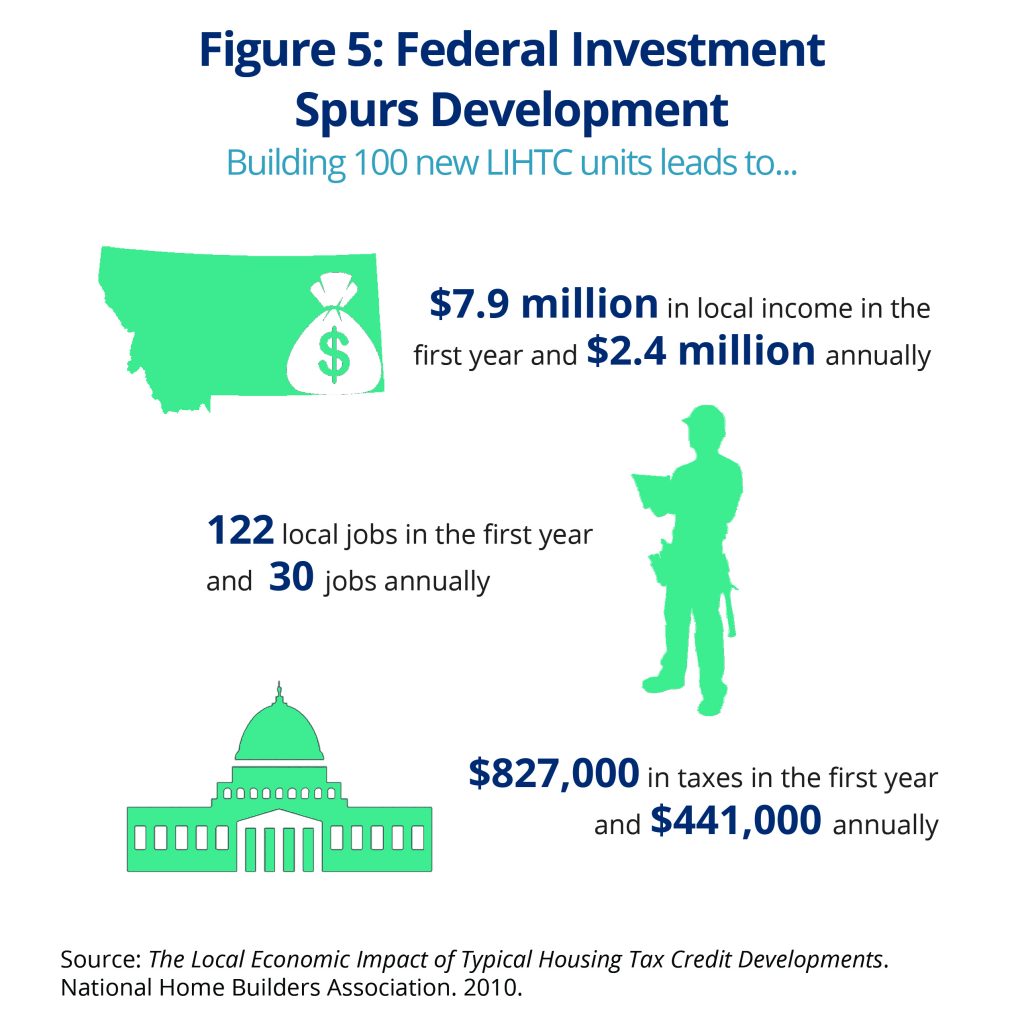

Bringing the cost of housing down can save local businesses money associated with high employee turnover rates. A meta-analysis on the costs of turnover across various industries demonstrated that replacing a single worker earning $30,000 or less annually can cost a business 16 percent of that employee’s salary.[60] By this estimate, a Montana business could save $4,800 by retaining one employee.  Affordable housing development and assistance brings federal dollars into communities which boosts the local economy. Federal Low-income Housing Tax Credits (LIHTC), established by Congress in 1986, account for most of the housing assistance provided indirectly to low-income households. LIHTC provides federal tax credits to housing developers in exchange for building or rehabilitating rental housing that is affordable for low-income households. This program provides over $2.5 million in tax credits annually to finance the development of low-income housing in Montana communities.[62] LIHTC has had a tremendous impact in Montana. Since the program was established, LIHTC projects have financed 7,500 new homes for over 17,400 low-income families.[63] The injection of federal funds has a rippling effect in local communities. LIHTC investments have generated $808 million in local income for communities and supported 8,480 jobs since the creation of the program.[64]

For every 100 rental homes supported by low-income housing tax credits, local economies gain $7.9 million in income, $827,000 in taxes and other revenue for local governments, and 122 jobs from the construction.[65] For every dollar spent on capital and maintenance of public housing, this investment adds $2.12 of indirect and induced economic activity.[66]

In addition to federal tax credits, housing choice voucher payments can generate significant economic activity. In 2016, property owners in Montana received $30.89 million in voucher payments, which helped them pay for property taxes and prevent blight by maintaining their properties in good condition.[67]

Conclusion

State and federal investments in housing offer more than the dollar value of rent. Montana is stronger when all our residents have an affordable, safe, and stable place to call home. Affordable housing benefits individual families, the neighborhoods they live in, and our broader economy. Without state resources to expand housing affordability, more Montanans will become vulnerable to financial insecurity, poor health, and homelessness, while local economies struggle to grow. Montana should invest in the future of its children and communities by increasing the levels of assistance available and targeting its resources to meet the housing needs of its families.

Affordable housing development and assistance brings federal dollars into communities which boosts the local economy. Federal Low-income Housing Tax Credits (LIHTC), established by Congress in 1986, account for most of the housing assistance provided indirectly to low-income households. LIHTC provides federal tax credits to housing developers in exchange for building or rehabilitating rental housing that is affordable for low-income households. This program provides over $2.5 million in tax credits annually to finance the development of low-income housing in Montana communities.[62] LIHTC has had a tremendous impact in Montana. Since the program was established, LIHTC projects have financed 7,500 new homes for over 17,400 low-income families.[63] The injection of federal funds has a rippling effect in local communities. LIHTC investments have generated $808 million in local income for communities and supported 8,480 jobs since the creation of the program.[64]

For every 100 rental homes supported by low-income housing tax credits, local economies gain $7.9 million in income, $827,000 in taxes and other revenue for local governments, and 122 jobs from the construction.[65] For every dollar spent on capital and maintenance of public housing, this investment adds $2.12 of indirect and induced economic activity.[66]

In addition to federal tax credits, housing choice voucher payments can generate significant economic activity. In 2016, property owners in Montana received $30.89 million in voucher payments, which helped them pay for property taxes and prevent blight by maintaining their properties in good condition.[67]

Conclusion

State and federal investments in housing offer more than the dollar value of rent. Montana is stronger when all our residents have an affordable, safe, and stable place to call home. Affordable housing benefits individual families, the neighborhoods they live in, and our broader economy. Without state resources to expand housing affordability, more Montanans will become vulnerable to financial insecurity, poor health, and homelessness, while local economies struggle to grow. Montana should invest in the future of its children and communities by increasing the levels of assistance available and targeting its resources to meet the housing needs of its families.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.