Helping Seniors: Montanan's Elderly Homeowner and Renter Tax Credit

Aug 16, 2019

By Tara Jensen

In honor of Senior Citizen’s Day, MBPC would like to reflect upon a progressive part of Montana’s tax code - the elderly homeowner and renter credit. Montana’s elderly homeowner and renter tax credit is a credit for a portion of property tax paid by seniors living on low-incomes who rent or own their homes.

One basic principle of fair taxation is that taxes should reflect the taxpayer’s ability to pay. Property taxes are disconnected from income, and as property values rise, they can become unsustainable for many residents, whether paid directly by owners or indirectly by renters.

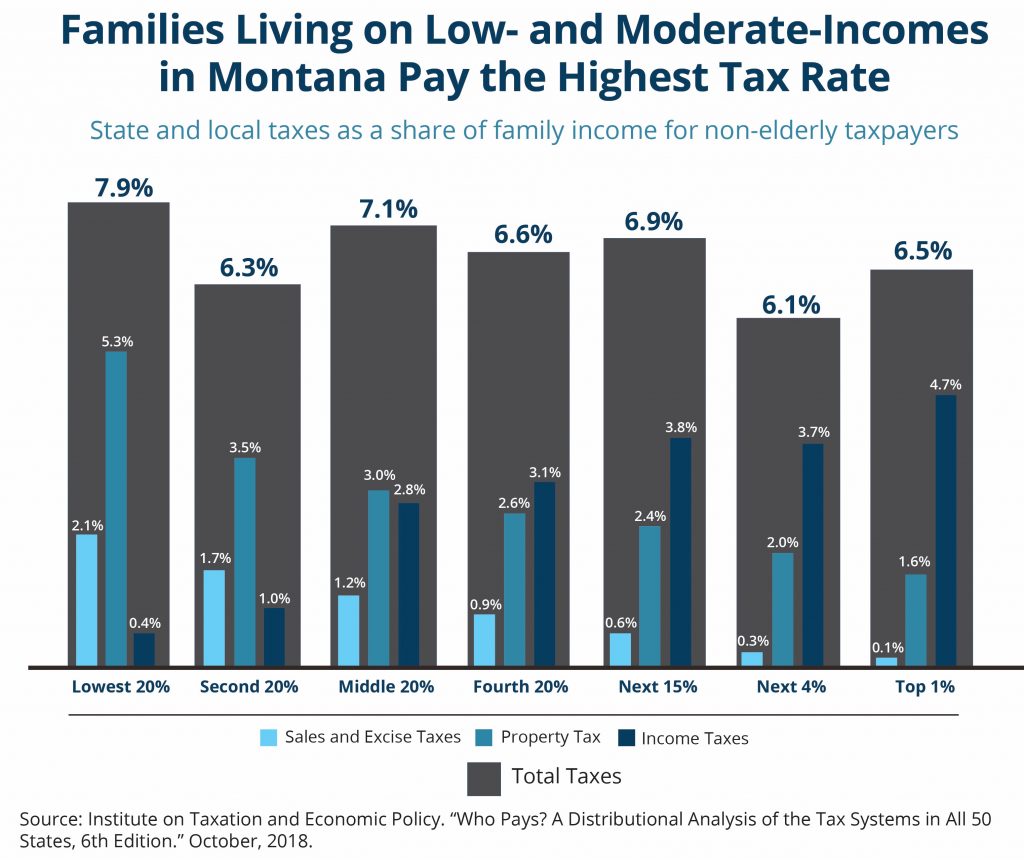

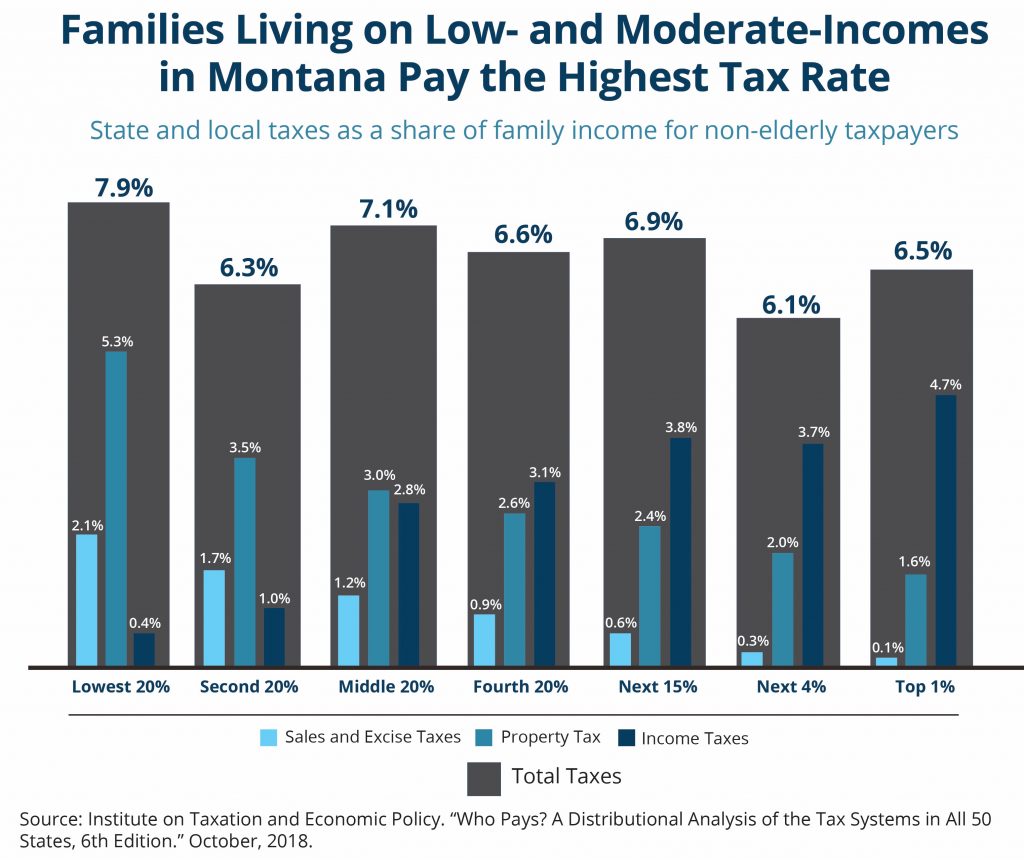

Montana’s current tax system is regressive, meaning families living on low- and moderate-incomes pay a higher share of their income on taxes than the wealthy.

As households living on low- and moderate-incomes tend to spend more of their income on housing than higher-income families, property taxes are one of the more-regressive taxes in Montana. The elderly homeowner and renter credit helps to remove some of that regressivity, making property taxes more affordable for elderly households with low- and moderate-means.

The elderly homeowner and renter tax credit is a cost-effective way to provide a boost to elderly families, many of who are living on fixed incomes. This money helps these families deal with rising property taxes when they have limited recourses. The elderly homeowner and renter credit should be continued in years ahead, to help future Montanans afford reasonable housing.

The elderly homeowner and renter tax credit is a cost-effective way to provide a boost to elderly families, many of who are living on fixed incomes. This money helps these families deal with rising property taxes when they have limited recourses. The elderly homeowner and renter credit should be continued in years ahead, to help future Montanans afford reasonable housing.

The elderly homeowner and renter tax credit is a cost-effective way to provide a boost to elderly families, many of who are living on fixed incomes. This money helps these families deal with rising property taxes when they have limited recourses. The elderly homeowner and renter credit should be continued in years ahead, to help future Montanans afford reasonable housing.