CARES Act: Frequently Asked Questions About Recovery Rebates

Apr 10, 2020

By Tara Jensen

This post was originally posted on April 10 but was updated on April 16.

On March 27, 2020, Congress passed the Coronavirus Aid, Relief and Economic Security Act (CARES Act) a $2.2 trillion package that includes direct financial assistance to many families, unemployment support, necessary resources to address impending fiscal cliffs faced by state and local governments, and more. Here are answers to some of the questions about who receives rebates and how to get them.

What are the recovery rebates?

The

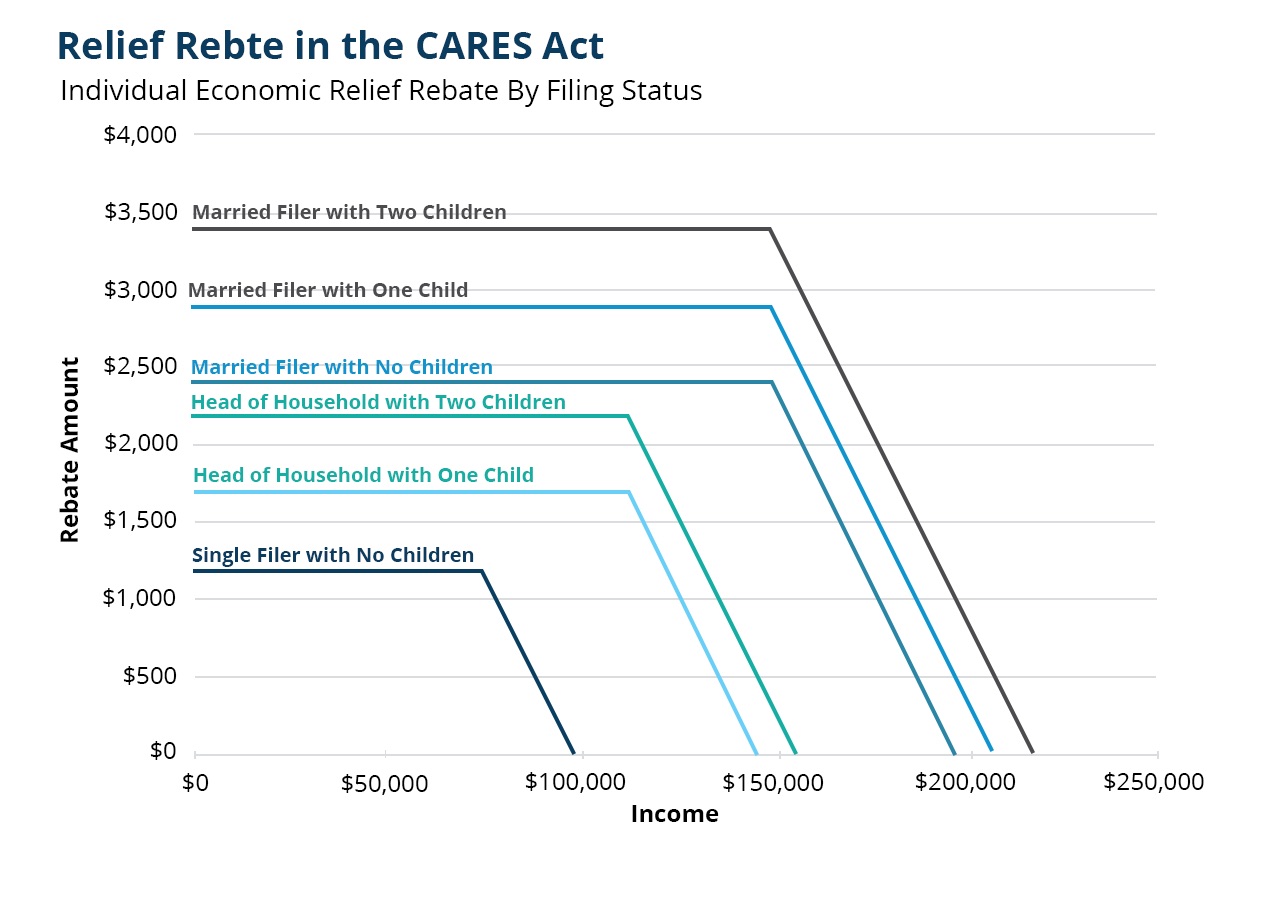

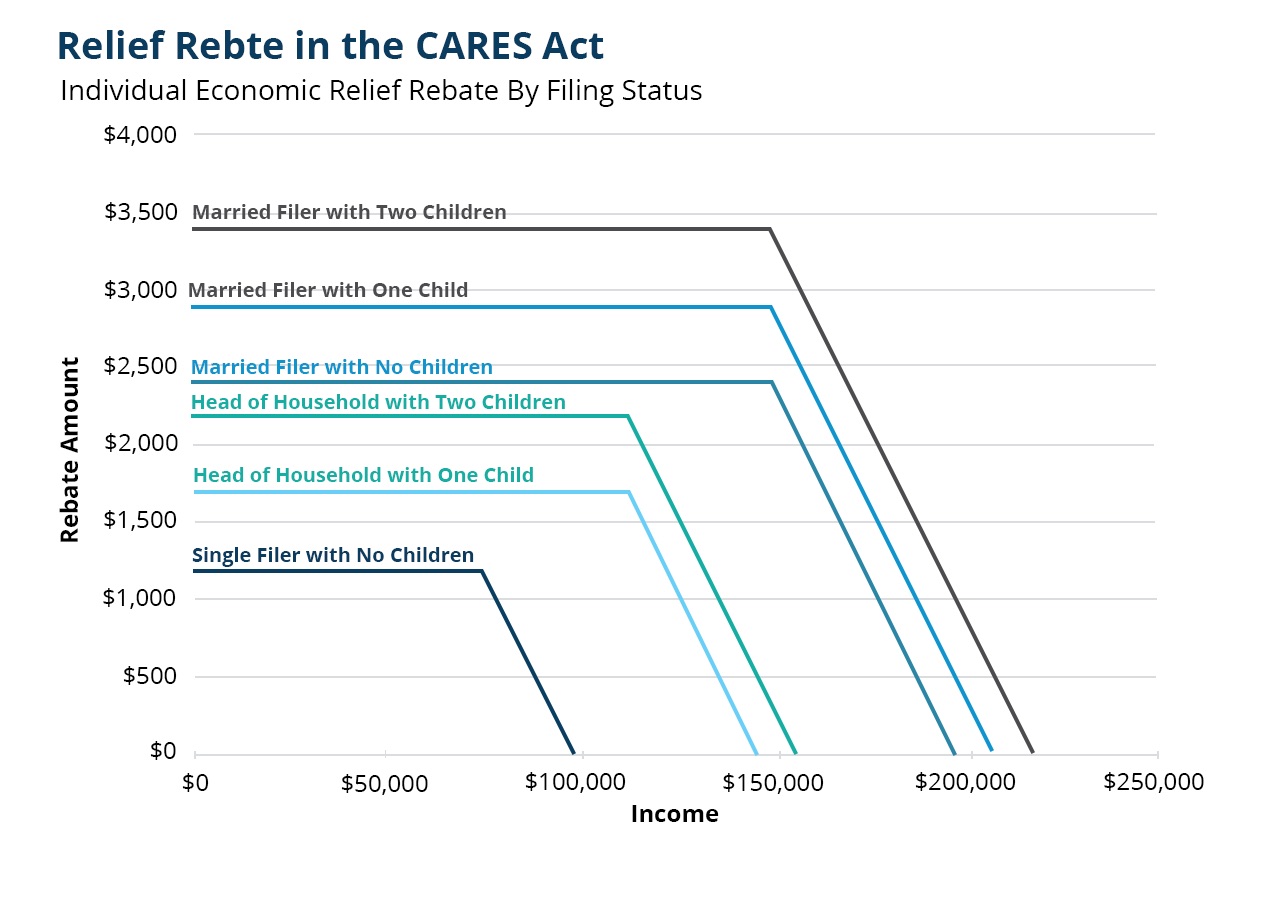

CARES Act authorized direct one-time payments to individuals and families of $1,200 per adult and $500 per dependent child 16 or younger. The payments begin to phase out at annual earnings of $75,000 for single individual, $112,500 for a single head-of-household with one or more dependents, and $150,000 for a married couple. The payment is reduced by $5 for every $100 above those thresholds, fully phasing out at $99,000 for single individual or $198,000 for married couple.

Montanans are expected to receive a total of $1.105 billion in recovery rebates.

What if I haven’t filed my 2019 taxes?

The IRS will use income reported on 2019 tax filings to determine if people are eligible for the rebate. If 2019 taxes have not been filed, the information on 2018 tax returns will be used to determine eligibility.

What if I didn’t file my 2018 taxes?

Anyone who has not yet filed a 2018 or 2019 tax return should do so as soon as possible, and provide their direct deposit information on the return for the rebate payment. For those receiving social security, the IRS will use that data to generate a rebate without having to file. Those that may be on other assistance, such as Supplemental Security Income (SSI) or Temporary Assistance for Needy Families (TANF) but are required to file a tax return, will need

to file to receive their rebate.

Not everyone is required to file their taxes; for those who are not, the here is the

IRS link to enter information to receive your stimulus check. The rebates will be available through the rest of 2020.

When can I expect my recovery rebate?

The Treasury Department and IRS announced March 30 that the distribution of the rebates would begin sometime in first three weeks of April. The IRS will be sending a letter to each taxpayer’s last known address about the recovery rebates, up to 15 days after payments are made. The letter will give instructions to follow if payment was not received. People should be careful of scams related to the recovery rebates, and individuals should check the

IRS website to confirm information in a letter, if they are unsure if a letter received was legitimate.

What if I didn’t do direct deposit for my tax returns?

For individuals with direct deposit information on file with the IRS, the rebates will be deposited. Individuals who may not have direct deposit information on file can check and enter information through a

web-based portal. Otherwise, checks will be mailed. Individuals who do not typically file tax returns will need to submit a

simple tax return to receive their rebates.

Is everyone eligible for a rebate?

No. Those who are dependents age 17 and over or immigrants who file taxes via the Individual Taxpayer Identification Numbers (ITIN) are not eligible for a rebate.

Will the rebate affect my 2020 tax refund?

The rebate is a refundable tax credit for 2020, paid out in advance, and in general, should not affect a taxpayer’s 2020 tax refund. The only way the rebate would reduce a taxpayer’s 2020 refund would be if their 2019 (or 2018) income was lower than 2020 income, and they didn’t qualify for as much of the credit as they received. For example, if a single taxpayer made over $75,000 in 2020, but under $75,000 in 2019 and received the rebate based on their 2019 income, they would have to pay the excess amount back when paying their 2020 taxes.

What if my family household has changed since my most recent tax filing?

To update household filing status, file or amend your 2019 return as soon as possible. For changes in address, a

temporary change of address notice is available through USPS, a

form may be filed with the IRS, and taxpayers may

write to the IRS informing them of a change of address, which should redirect checks which will be sent if the IRS does not have correct direct deposit information.

If the changes are not caught by the time refund checks are issued, the changes will be made in 2020 tax filings.