During the pandemic, there have been many news headlines about the widening wealth gap in the United States. While true, wealth and income gaps existed long before COVID-19, particularly along lines of race. That is no accident. Rather, these gaps are the product of our country’s ongoing history of racist, biased, and discriminatory policies and practices against Black, Indigenous, and people of color (BIPOC). The pandemic has simultaneously made us acutely aware of that fact while also exacerbating the problem.

For starters, let’s distinguish wealth from income and income from wealth. The two terms are commonly used interchangeably but have different meanings. Income is what we get from our employer, our business, rents on properties, and so on. Say, for example, you work at a grocery store that pays you for your work. That is income. On the other hand, wealth represents savings, so it is accumulated over time, and tends to be higher than income. Wealth includes money in the bank, property and land owned, jewelry and art, and the like.

Both wealth and income are essential to long-term financial security. Without income, it is hard to meet basic everyday needs, such as groceries, diapers, school supplies, and clothes. In other words, income helps measure day-to-day economic resources. Wealth gives people a cushion if they lose their job or fall on hard times and allows for big investments in things that can grow wealth, such as higher education and property. Wealth can also generate income through accrued interest on bank deposits and dividends on stocks, for example.

It is possible to have wealth and little or no income. Take owning a home and living on a modest pension as one example. As a different example, take a billionaire, like Jeff Bezos. According to a July 2021 report from the Center on Budget and Policy Priorities, as of 2020, Bezos received an annual salary of $81,840, a modest income for the world’s richest person. Bezos also has wealth in the form of Amazon stock, which grew by more than $100 billion between 2010 and 2018. So, while Bezos has a relatively low income (for the world’s richest person), he has tremendous wealth.

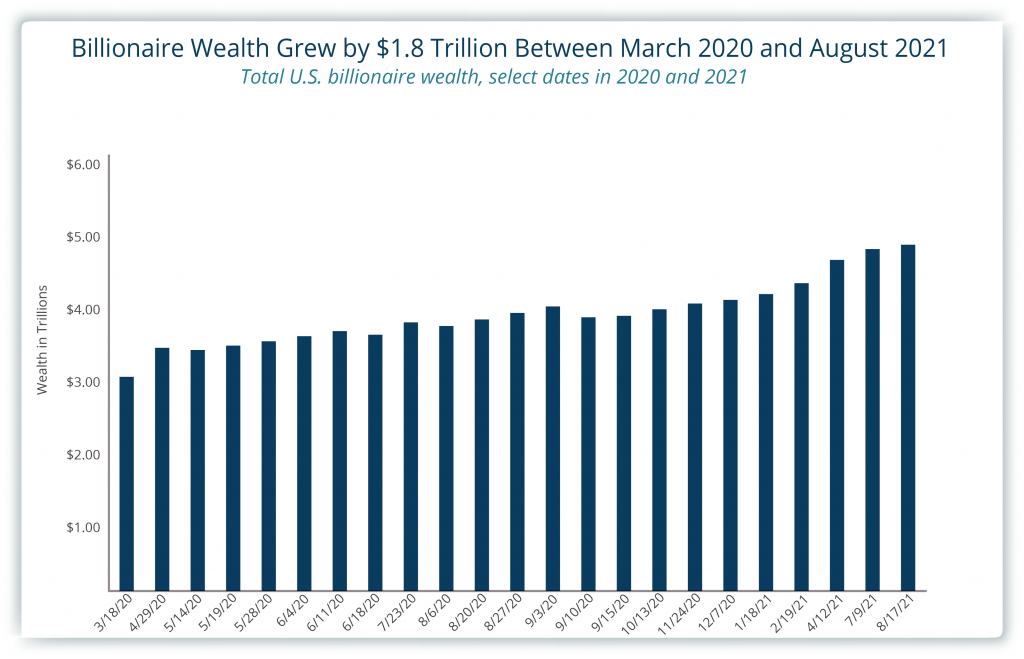

The pandemic is deepening wealth inequality. According to reporting from August 23, 2021, in the first 17 months of the pandemic, billionaires in the United States saw their wealth increase by $1.8 trillion, an amount roughly 144 times the size of Montana’s $12.5 billion 2023 biennial budget. That has happened as the economic downturn of the pandemic has hit ordinary people. Of those billionaires, Elon Musk alone saw his wealth grow by $150 billion, and Jeff Bezos watched his wealth increase by $75 billion. It is not just the wealth of individual billionaires that is increasing, but so is the number of billionaires (from 614 to 708). For perspective, if those 708 billionaires were to sit in the University of Montana’s football stadium (capacity of 25,217), the stadium would be about 97 percent empty. We are talking about a very privileged few here. As a reminder, wealth can generate income, so even if wealthy people (millionaires and billionaires) have relatively little income, they still have resources to finance lavish lifestyles.

This concentration of wealth largely benefits white people. According to an April 2021 report from the Center on Budget and Policy Priorities, the wealthiest 10 percent of white U.S. households hold nearly two-thirds of the country’s wealth. According to September 2020 research of pre-COVID wealth from the Board of Governors of the Federal Reserve System, the average white family had eight times the wealth of the average Black family and five times the wealth of the average Hispanic family before the pandemic. These numbers represent more than a point in time – they represent the historical injustices perpetrated by racist, biased, and discriminatory policies and practices against BIPOC people. Wealth, or a lack thereof, can persist across generations. The accumulation of wealth represents access to homeownership opportunities, the passing down of resources from generation to generation, the ability to save, and a tax code that favors wealth over income, among other things. Remember, wealth can generate income, which also means that it can deepen income inequality.

White people have been more insulated from the financial impacts of COVID. Americans with higher incomes, who are more likely to be white because of ongoing historical racist policies and practices, have had more flexibility to work from home, protecting them from the virus and the economic downturn. In fact, households with annual incomes of $200,000 or more were nearly six times as likely as households with annual incomes of less than $25,000 to have switched to telework in 2020.

BIPOC people are overrepresented in jobs the pandemic hit the hardest. A July 2021 analysis by the Economic Policy Institute shows that while the overall unemployment rate fell, white people fare better. As of the analysis, Hispanic workers were still nearly 70 percent more likely than white workers to face unemployment, and Black workers were twice as likely as white workers to face unemployment.

Wealth inequality helped white people who lost job-related income. For example, according to a July 2021 report from the Center for American Progress, nearly 46 percent of white households that saw job-related income loss used savings to cover expenses, compared to roughly 31 percent of Black households. This means that when households needed to rely on savings, fewer Black families could do so, despite the disproportionate impact of the pandemic on Black people.

While undeniably linked, income and wealth are distinct. Our country’s ongoing history of racist, biased, and discriminatory policies and practices deny BIPOC people equitable access to either, creating an uneven recovery from the pandemic. Lawmakers in Congress and the Montana Legislature can do something about this. Some solutions include providing financial support for BIPOC entrepreneurs to start and grow their businesses, investing in early child care and education, providing financial support for higher education, and strengthening taxation of wealth and high incomes to sustain transformative investments in BIPOC communities.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.