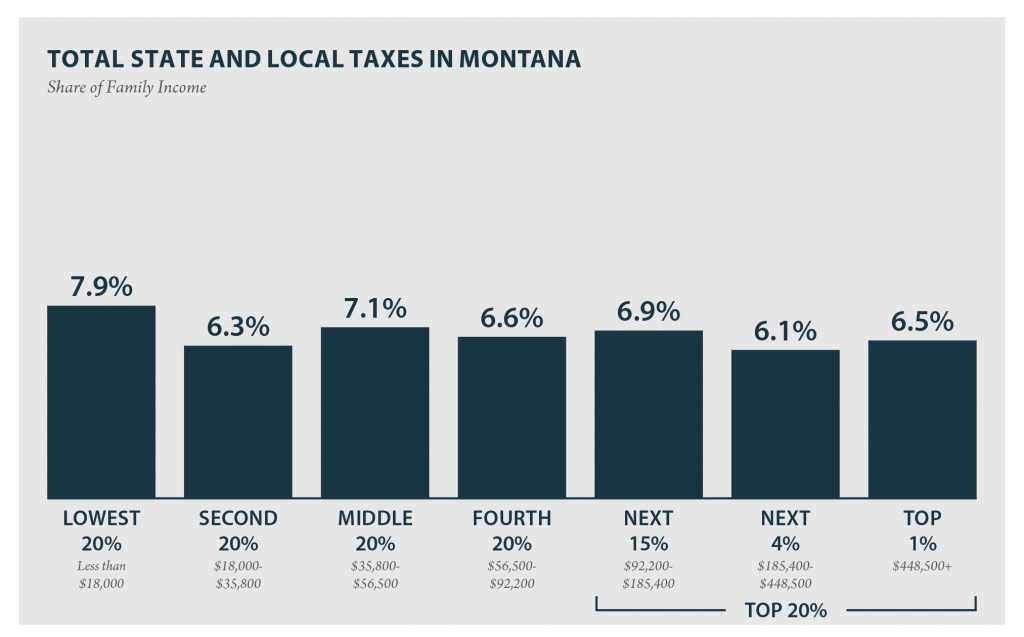

One of the reasons that Montana’s tax system is less regressive than some states is our lack of a statewide sales tax, as we explain in more detail in this report. Taxpayers with low- and middle-incomes spend a larger proportion of their income on goods and services than higher-income taxpayers. Thus, sales taxes are regressive. While Montana does have a few sales and excise taxes that are more proportionally paid by households with lower- and middle-incomes, the impact of these taxes is much smaller on Montana’s overall tax system than a general statewide sales tax.

Next, let’s look at property taxes. Montana has a statewide property tax system. Property taxes are regressive because households with low- and middle-incomes tend to spend more of their income on housing than higher-income households. For example, a household earning $50,000 a year may own a house worth $100,000 or twice their annual income while a household earning $1 million a year may own a house worth $500,000 or half of their annual income.

Individual income tax is Montana’s largest source of tax revenue. Montana’s graduated income tax schedule is a progressive feature of the individual income tax, but as a taxpayer reaches the top income tax rate at $17,900, one-person households within 150 percent of the federal poverty level and three-person households within 100 percent of the federal poverty level are paying the top tax rate. A top tax rate on higher-income households would improve the fairness of Montana’s income tax system.

While Montana is ahead of some states in the progressivity of our tax system, there is still room to improve. This session, the Montana Legislature has the opportunity to pass a top tax rate on households earning $400,000 or more. This would help fund schools, roads, bridges, and public services each year while making Montana’s tax system more equitable.

One of the reasons that Montana’s tax system is less regressive than some states is our lack of a statewide sales tax, as we explain in more detail in this report. Taxpayers with low- and middle-incomes spend a larger proportion of their income on goods and services than higher-income taxpayers. Thus, sales taxes are regressive. While Montana does have a few sales and excise taxes that are more proportionally paid by households with lower- and middle-incomes, the impact of these taxes is much smaller on Montana’s overall tax system than a general statewide sales tax.

Next, let’s look at property taxes. Montana has a statewide property tax system. Property taxes are regressive because households with low- and middle-incomes tend to spend more of their income on housing than higher-income households. For example, a household earning $50,000 a year may own a house worth $100,000 or twice their annual income while a household earning $1 million a year may own a house worth $500,000 or half of their annual income.

Individual income tax is Montana’s largest source of tax revenue. Montana’s graduated income tax schedule is a progressive feature of the individual income tax, but as a taxpayer reaches the top income tax rate at $17,900, one-person households within 150 percent of the federal poverty level and three-person households within 100 percent of the federal poverty level are paying the top tax rate. A top tax rate on higher-income households would improve the fairness of Montana’s income tax system.

While Montana is ahead of some states in the progressivity of our tax system, there is still room to improve. This session, the Montana Legislature has the opportunity to pass a top tax rate on households earning $400,000 or more. This would help fund schools, roads, bridges, and public services each year while making Montana’s tax system more equitable.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.